My grandfather died when I just entered my first year in college. That was a year after he persuaded me to take the scholarship exams entitled to all residents and high school graduates of my mother’s hometown in Pampanga. He was very patient that he even accompanied me throughout the application process. He even waited outside the examination venue until I finished.

The reason? I didn’t know much about the Kapampangan dialect except for “mekeni”, “nanung lagyu mu?”, “ebun”, “masanting”, “maragul”, “manyaman”, and…never mind. 😛 He had to be there for me to be my translator. To speak the dialect was supposed to be a proof that I am a legitimate half-Kapampangan. A requirement to become eligible for the scholarship. But technically and biologically-speaking, I’m a Batangpangan (Batangueño–Kapampangan) born in Manila.

To cut the story short, I passed the scholarship exam and went on to finish college with top honors. I placed 46th…among 55 students. 😛 And I owed everything both to my parents and to my departed grandfather for believing that I could get the scholarship and finish it.

“Save Up For Your Retirement”

This was what my grandfather told me during those days. Never understood it until recently.

He believed that if I graduated from Accountancy course, I would be able to land a good job, save up, and improve the financial condition of our family. Take note that the family here means the whole family tree from my mother’s side. I was the first among his grandchildren to finish college.

Well, my grandfather probably knew that he’d be gone soon. Knowing that he only had his SSS pension to leave as a legacy to my grandmother, perhaps he was trying to tell me that I should not rely on SSS alone to feed my future wife and my family in my old age or when the time comes when St. Peter calls me up.

Never Rely On Your SSS Retirement Benefit Alone

Did you know that you can not contribute more than Php1,560 a month for your SSS unless you are an employee in a Philippine company? Oh yes, you can add Php30 to your maximum monthly contribution if you are an employee.

So even if you contribute the maximum Php1,590 during your youthful days and you’re earning an average of Php15,000 per month, you will only get a monthly pension benefit of Php9,300 during your retirement years.

This is based on the formula stated in the SSS website:

The monthly pension depends on the members paid contributions, including the credited years of service (CYS) and the number of dependent minor children but not to exceed five. The amount of monthly pension will be the highest of:

1.) the sum of P300 plus 20 percent of the average monthly salary credit plus 2 per cent of the average monthly salary credit for each accredited year of service (CYS) in excess of ten years; or

2.) 40 per cent of the average monthly salary credit; or

3.) P1,200, provided that the credited years of service (CYS) is at least 10 or more but less than 20 or P2,000, if the CYS is 20 or more. The monthly pension is paid for not less than 60 months.

Tell me if that’s enough for you by that time.

Today, my 87-year young grandmother receives a monthly pension of Php3,400 as the primary beneficiary of my late grandfather who worked as a security guard for the Cojuangcos. (Now I co-own the companies owned by them through the stock market). That Php3,400 is not even enough to buy all her medicine.

I know, it’s a reminder to us all her children and grandchildren to continue supporting her medication and everything that she needs.

It’s also a wake-up call that we should not rely our retirement years on pension provided by SSS or GSIS alone. It’s a good start but it should never be our sole source of “income” for the remaining years of our lives. We have to invest in various financial instruments that earn more as early as possible (and just as important, get yourself insured).

That way, you will not only be able to help yourself and your family now and during your old age. You can even start helping others NOW.

“Consider this: Whoever sows sparingly will also reap sparingly, and whoever sows bountifully will also reap bountifully. Each must do as already determined, without sadness or compulsion, for God loves a cheerful giver. Moreover, God is able to make every grace abundant for you, so that in all things, always having all you need, you may have an abundance for every good work..” – 2 Corinthians 9:6-8

Receive more inspirational finance posts by subscribing to BurnGutierrez.Com for free.

P.S. 1. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

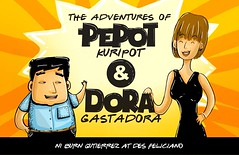

P.S. 3. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. Order your copy now from our website http://pepotanddora.com and have it delivered right at your doorstep. Or you can grab your copy yourself at The Pantry at 07 in Makati City and ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 4. If you are based abroad or just outside of Metro Manila and has been itching to learn more on how to jumpstart your business dreams, join me and my friend, serial entrepreneur Ginger Arboleda, as we take you through a series 2-hour webinars (for 11 Saturdays) that will help you focus on the technical skills and specific things that you have always wanted to know about in order to grow your business. We have come up with 10 sessions with 11 expert lecturers (with 1 FREE session if you enroll in the full program) that will make you a stronger and better entrepreneur. Register here to join the Enter Entrepreneurship Webinar Program now!

P.S. 2. The 1st Angat Pilipinas Personal Finance Awards has opened the nominations phase for the Blogger of the Year, the Author of the Year, Advocacy Group of the Year, OFW Advocate of the Year, and the Institution of the Year Awards. Got someone in mind? Submit your nominations here!

P.S. 3. Angelpreneur and EntrepChamp Paulo Tibig will be gracing our next webinar called “Make Your Business Idea Happen” on November 15, 2013 , Friday at 3PM (Philippine time). Paulo will be answering your questions about your business ideas, how to start or expand one, and how to successfully sustain it. To attend this FREE and LIVE Q&A sessions, please register here.

P.S. 4. From Bo Sanchez: We’ll Airdrop Food To Far-flung Towns – NEWS: From a chartered plane, hundreds of sacks of food and water will be airdropped to far-flung towns in Leyte. (The plane can’t land, so this is the only way. We’re also in touch with coordinators in the area to receive the airdrop.) Each sack will be enough for a family of 5 to eat for 3 days. The Alabang Feast is coordinating this bold project. All our other Feasts are collecting food/clothes/water and bringing them to the Alabang Feast in Festival Mall. Thank you so much, Light of Jesus Family and all the Feasts who are making this happen. Please pray because the Alabang Feast is also now contacting a helicopter company to help us airdrop more food. If this pushes through, we can airdrop 15 tons of food.

PS. You can continue donating to Yolanda Victims…

Account Name – Light of Jesus Community Foundations Inc.

Bank Name – Metrobank

Branch – E-Rodriguez branch

Account # – 265-7-26551395-2

Please fax your deposit slip with your Feast name to Annie at 7268951 or email feastsecretariat@yahoo.com

—

Photo credit: Lady Wulfun

Very true. That is why I onced wrote in an article that Living On SSS translates to LOSSS. We should meet LOI (Living On Interest) to be financially free..

I totally agree sir Mon.

My Lola was in the same boat. She had about 4K from SSS – and that was after retiring as part of higher mgmt in her company.

It wasn’t enough for her meds either.

That made me realize early on that I’d have to start saving for retirement.

Great post burn. Hopefully a lot of people start thinking more about their future – that extends beyond the next xmas/bday gadget to buy.

Our Lolos and Lolas shoud be our “benchmarks” on how we should prepare for our retirement years. Relying on SSS or GSIS pension alone won’t last until our last breath.

65 years old in fact is still a very young age these days. Most people last up to early 90’s or even past a century. That’s still 35 years more! We need more money to enjoy life for that extension!

So true… a lot of people keeps on praying to God for financial blessings but do things contrary to their prayers. They always think tat God will provide. Yes God provides the solution but we have to ACT on it. Hindi pwede laging spoon feeding.

Is it ok not to contribute to SSS if you have already invested in stocks for your retirement?

It’s not about comparing SSS contributions versus investing in stocks. The question is are you protected and insured NOW?

If you don’t have any insurance to back you up and your investments today, perhaps a small contribution to SSS will matter when that bad day comes. But then again, it will never be enough. Get an insurance as you are investing in stocks or other assets for that matter for your future/tomorrow.

I live and work abroad and stopped contributing for years. I was thinking if it’s possible to pull out all my contributions in SSS and invest it in our stock market?

The point of the article is to set aside a separate fund from your current income to be invested for your retirement. Just forget about the contributions you made to SSS. Get yourself and your family members medical and life insurance.

You discussed SSS only, how bout GSIS? I think GSIS do not have limit in their contributions, only percent of your GMI.

GSIS offers far different than SSS. I heard they are giving your last salary as your monthly pension given you have met their conditions. I have 1 friend and she is receiving 24k every month as her pension. She is also entitled in increment. Just dunno if they are giving an annual increment or periodical increment but once the gov’t declared an increase they are also entitled.

Im 36 years old. I started my contributions in 1999. But in 2010 since I am earning more here abroad..i decided to pay maximum of monthly contributions. Still my question is …how much will i receive monthly when i reach 69 years old. I have 2 kids. Until which year i pay my monthly contributions to maximum.