My mother used to work as a clerk for a Chinese businessman in Binondo back in the early 70’s when she was still single. But she decided to stop working when she met my father until they got married in 1975. Given the very short time that she spent for working, she did not get to contribute that much for her Social Security.

Fast forward to 2012, my mother asked me if she could continue to contribute to SSS so that she could receive the pension when she reaches her retirement age. After giving her a computation on how much (little) she could get from SSS, I convinced her that she should not rely her retirement years from SSS alone.

In fact I told her that it would be better to allocate a portion of the money I’m giving her on a monthly basis and the profit she is getting from her small business of made-to-order delicacies to invest in the stock market.

And so she did in December 2012.

What Set of Companies Is My Mom Investing In?

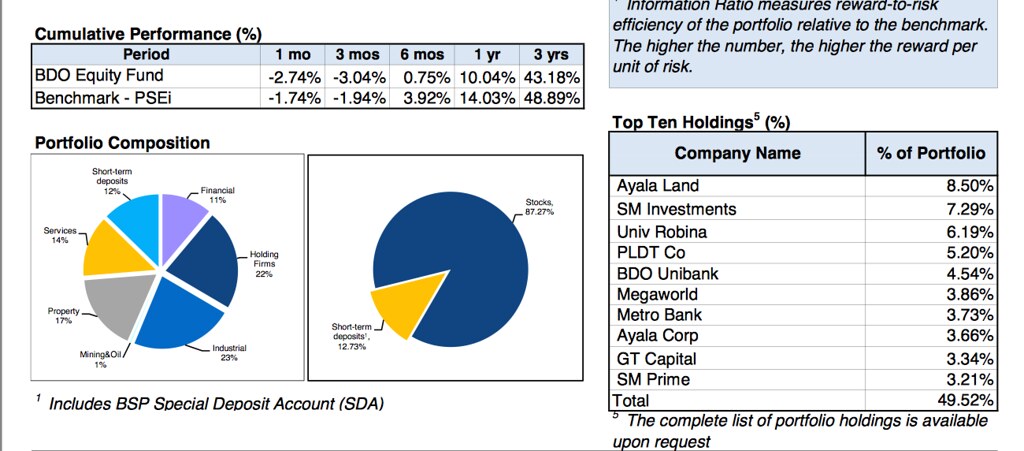

Believe it or not, my mother’s investing in at least 10 great, blue chip companies in the land. Trumpets and drum roll, please.

Not only is she investing in great companies. She’s also diversifying her investments through different types of industries and securities.

See that 12.73% “Short-term deposits” in her portfolio diversification? That’s right, aside from investing in equities, she’s also entrusting her money in BSP’s Special Deposit Account or SDA.

How Is She Doing All That If She Has No Financial Background?

To clear things out, my mother has very little knowledge about investing. In fact, it’s only through our informal talks that she gets what investing in stocks mean. Because of that, she decided to entrust her small earnings to a fund manager.

That’s right. My mother is investing “indirectly” in the stock market through BDO’s Equity Fund via their Easy Investment Plan (EIP).

With as little as Php2,000 per month, she’s investing in those great companies in the Philippines. And as she invests, I continue to feed her “elementary” information on how to improve her finances and make the little money that she makes grow further for her retirement years.

It’s never too late to learn. Anytime is the best time to invest!

Be guided in your journey towards financial independence by subscribing to BurnGutierrez.Com for FREE.

Rock your way to abundance!

P.S. 1. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

P.S. 2. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. Order your copy now from our website http://pepotanddora.com and have it delivered right at your doorstep. Or you can grab your copy yourself at The Pantry at 07 in Makati City and ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 3. If you are based abroad or just outside of Metro Manila and has been itching to learn more on how to jumpstart your business dreams, join me and my friend, serial entrepreneur Ginger Arboleda, as we take you through a series 2-hour webinars (for 11 Saturdays) that will help you focus on the technical skills and specific things that you have always wanted to know about in order to grow your business. We have come up with 10 sessions with 11 expert lecturers (with 1 FREE session if you enroll in the full program) that will make you a stronger and better entrepreneur. Register here to join the Enter Entrepreneurship Webinar Program now!

P.S. 4. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. We just opened up the enrollment for our “Money Tree System” online program. Read the entire letter as this is a limited opportunity. Remember, the enrollment is open until this Friday, August 29 only. So you better act now if you want to join the “New Rich“. Click here to reserve your spot.

P.S. 3. If you have friends who are struggling professional musicians and artists, please invite them over to attend our FREE Personal Finance Management Seminar for Artists and Musicians focused on improving one’s behavior towards money and how to properly manage it. This is happening on October 26, 2013, 3PM at The 70′s Bistro in Anonas Street, QC. They can text 0916-3624596 or email admin@pinoymundobiz.org for reservations. Visit www.pinoymundobiz.org for updates.

P.S. 3. The Angat Pilipinas Coalition for Financial Literacy and OFW UsapangPiso Forum will be conducting its first ever webinar in 2013 entitled “Creating Wealth – Smart Personal Finance Habits for OFW’s” on February 28, 2013 at 3pm (Philippine time). The webinar will feature my fellow blogger and personal finance advocate Fitz Villafuerte and he will discuss about how one can spend less than what he earns, being frugal and saving money, finding ways to earn more income, learning more about investing, and paying it forward and giving back. And by the way, the webinar is also open to non-OFW’s. Register here now!

P.S. 4. OFW’s based in Dubai, UAE and Muscat, Oman will get to experience the passion and wisdom of personal finance guru Randell Tiongson this coming March. You may get in touch with me if you would like to attend the coffee table sessions with Randell right after the Ayala Land events so we can coordinate for a slot. You may send an e-mail to burngutierrezblog@yahoo.com.ph. Kindly indicate your full name and mobile number in your email.

good day Burn. I am a plain housewife who wants to have an extra income for my family, i am interested to know more about investing like your mom did.So please inform me more of the business.Thank you.

Hi Rhona, my mother is actually investing “indirectly” in the stock market via her bank’s Equity UITF (unit investment trust fund) since she doesn’t have the time and enough knowledge about stock market investing. It’s the equivalent of fund firms’ mutual funds. She is investing for her own retirement years.

If you have an account with major banks like BDO, BPI, Metrobank, you may inquire from them about UITF’s. For BDO, they have a program called EIP or Easy Investment Program where individuals can invest in UITF’s in small amounts, with a minimum of P1,000 per month only.

https://www.bdo.com.ph/personal/trust-and-investments/easy-investment-plan

Is it ideal to deposit a certain amount of money in my UITF account every month? Im invested on Bpi index fund but it went down for the past weeks. Please advise.

The best and most ideal strategy in UITF investing is using the cost-averaging method. Invest a fixed amount every month regardless of the fund’s share/unit prices.

Hi po. Iba po ba ung bdo eip sa bdo uitf? 7 months na kong may uitf and ever since walang gain.. Loss lang po ;( thank you po.

EIP is BDO program to make it easy to do UITF investment monthly to meet the 10k minimum amount of Equity Fund.

Keep a million faith, magka-gain din yan 🙂

hi burn! i’ve invested my first uitf-fixed income fund at BDO, yet until now, i incurred losses so i stopped den opened an equity fund.i’m so happy w/ the results.

Congratulations Lyn! Happy investing! 🙂

Sir burn ms mgnda po b s equity fund kesa po s uitf? Sir wala p po aq full knowldege regarding s investing s stick mrkt pero mdalas q pong bshin un mga blogs nio kya mdio khit pno po my naiintndhn po aq khit konti.. gsto q din po kc ung mama mkpginvest pra s retirement nia 52 n po xa and wala din po xa contribution s sss, ano po kya mgndns investment po pra sknya.. marsmaming slmt po

@lyn delas penas.. hi lyn. Can i ask how much u was ur first investment in equity fund?

Good day Mr Burn, This is a very inspiring article. I am Richard, an entrepreneur, i also have a COL Account, aside from direct stock investing, i am also offered with many other investment instruments from different institutions. An Investor’s greatest concern would be gains and charges from these called instruments in “Long-Term”. Would you be so kind to enlighten us with some of today’s investment instruments in terms of their performance vs Charges/Fees? Ex: Index funds, ETF, Vul, UITF etc. Thank you very much Mr. Burn.

Kung nag invest ka sa mga stock market, paano mo makukuha ang profit, monthly ba, daily, weekly o yearly….. Di ko alam paki explain lng po

Congrats on your mother for taking the right stepp, however

Equity fund is just mimicking the index, I am relatively sure that removing costs of a mutual fund (which average around 3-5% a year) you will have better returns buying the index linked etf.

48% is nothing special, also buying the SPY (US largest ETF) would have given you 59% growth over the past 3 years.

Also remember that actual return is relative, if you are practicing dollar cost averaging then you will be buying sometimes at the top of the market, and net returns will be diluted

I understand your point, David. However, the purpose of the article is to encourage and inspire many Filipinos, especially those with meager income, that they too can make their small savings grow through pooled equity funds or the stock market.

This particular investment program allows an individual to invest at least P1,000 or just over USD$20 a month. Remember that there are many Filipinos who earn less than $300 a month and this kind of investment facility can help them save and invest within their capacity.