It took some time before I was able to convince my OFW colleagues to open their first stock market investment portfolio. Every day I send them helpful articles about long-term investing, cost-averaging, fundamental analyses of big companies, and various financial literacy blogs.

Weeks after, they finally made the decision to start investing.

(Do you want to be guided in stock market investing from opening your account up to buying your first stocks? Click this link to help me guide you in your stock market investing journey.)

So how did they do it? What did they do first?

Here are the procedures that my colleagues followed to open their first ever stock market investment portfolio through my online stockbroker COL Financial Group, Inc. (formerly known as Citiseconline)

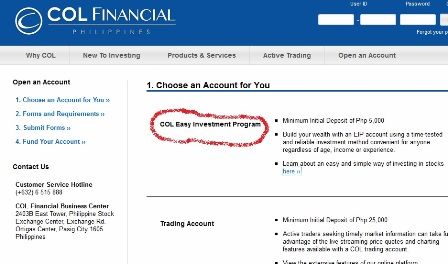

The COL Easy Investment Program (EIP)

I instructed my colleagues to read first the primer on EIP or the Easy Investment Program in the COL Financial website. It’s an 11-slide presentation explaining everything about EIP and how it will work for individuals who want to invest in the stock market but do not have time and enough knowledge about it.

The presentation is very simple and anyone who has the passion and determination to start investing for the future will definitely get an understanding on how this method of investing will benefit her/him.

For those reading this post and are interested to know about EIP, you may go to this link: COL Financial EIP Primer

The COL Financial EIP is a time-tested and reliable investment method convenient for anyone regardless of age, income, or experience.

Opening a COL EIP Account

When my colleagues finally had a grasp of what EIP is, they decided to open an account and went to this link: Open An Account with COL Financial

And then they chose the COL Easy Investment Program (EIP).

The COL Easy Investment Program (EIP) requires a very minimal initial deposit of Php5,000 only.

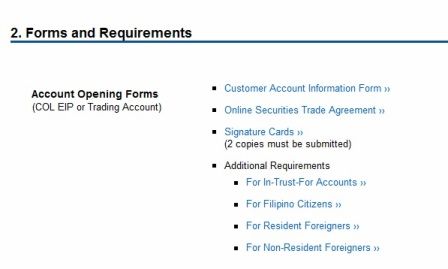

From this page, they downloaded the forms (2. Forms and Requirements>>) and checked out the other minimum documentary requirements.

I told my colleagues that it is very important that they fill out the Customer Account Information Form, the Online Securities Trade Agreement, and 2 copies of Signature Cards completely and legibly.

While COL Financial people are friendly and accommodating, they make sure that applicants fill out the forms in an orderly manner and that signatures are consistent in all forms. Be careful on that area of requirement.

Additional Requirements

As a Filipino citizen, you are simply required to submit the following additional requirements:

- (1) Photocopy or scanned copy of a government-issued Valid ID (ex. driver’s license, passport, SSS ID, senior citizen ID, voter’s ID) – photo and signature on the ID should be clear

- Billing statement (ex. utility bill, credit card statement, etc.) – name, address and date must be present in the statement – (Note: OFW’s may submit their credit card or bank statements in their country of work. Just make sure that the address you wrote on the forms and signature cards is the same as the address indicated in the credit card statement.)

- (UPDATE) – The Tax Identification Number or TIN is now required by the BIR so to learn how to get one if you still don’t have one, go here.

For those who want to open an account for their beneficiaries or children, you need to submit a copy of their birth certificate. You will also need to sign an In-Trust-For Supplementary Agreement form in addition to the three other forms.

When done filling out all forms, sign on all documents and photocopies of the additional requirements. Scan all of them and send to the COL Helpdesk via email.

**UPDATE: Additional requirements for Overseas Filipinos starting this November 2015

Since there is a reinforcement of policy that requires personal appearance of those who are opening an account, the OFW investor have two options:

1) Submit an original copy of a Bank Certification that you can request from your Philippine bank that you are their client.

2) Have an online interview via Skype. An applicant will need to show his valid passport to the Customer Account Officer through the webcam. This should be considered as personal appearance.

Review of Documents by COL Helpdesk

COL Financial will then review all the scanned documents that you submitted via email.

If everything looks okay for them, they will then send you an email advice to send all the original forms and documents via courier to their Head Office address:

COL Financial Business Center

24th flr. East Tower, Philippine Stock Exchange Centre,

Exchange Road, Ortigas Center, Pasig City

1605 Philippines

If you have any other questions, you can call their hotline +632-6-515-888

Funding Your Account

Once they receive your couriered documents, you will be provided with the Account Details.

They will then ask you to fund your account with Php5,000. Don’t worry. You can already use this amount to buy your first stocks later on.

Remember that you can only transfer funds online to your COL Financial account via BDO, Metrobank, and BPI.

It is important to indicate the COL Account Holder’s Name and COL Account Number when making payments to ensure proper and timely credit to your account.

Once you transferred the amount, you can call or send an email to the Helpdesk to confirm if the amount has been credited.

You will then receive an email indicating your username and password.

That’s it!

You’re now ready to buy your first stocks for your EIP.

Other Online Stockbrokers in the Philippines

For other online stockbrokers, you may check their respective websites and most probably the procedures will all be the same as COL Financial’s.

Just Google their company names and you will surely find their official websites. Or you can visit the PSE website for the complete list of stockbrokers.

On my future post, I will teach you how to set up your EIP and buy stocks regularly for the next 10 years and beyond.

Remember that before you invest on anything, make sure that you have a basic understanding on how that particular investment vehicle works.

It’s also very important that you observe a frugal spending habit, living below your means in order for your investing program to be successful.

Protect yourself and your family also with a life insurance and a 6-month worth of cash savings for your emergency fund.

Subscribe to BurnGutierrez.Com if you wish to know more about long-term investing in the stock market.

Join the OFW UsapangPiso Facebook Group and visit our AngatPH website to learn how to plan your finances the right way and how to grow your money in various financial instruments and investment vehicles such as stocks, mutual funds, UITF’s, bonds, money market, real estate, and others.

Rock your way to abundance!

#moneyliferocknroll

P.S. 1. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

P.S. 3. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. Order your copy now from our website http://pepotanddora.com and have it delivered right at your doorstep. Or you can grab your copy yourself at The Pantry at 07 in Makati City and ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 4. If you are based abroad or just outside of Metro Manila and has been itching to learn more on how to jumpstart your business dreams, join me and my friend, serial entrepreneur Ginger Arboleda, as we take you through a series 2-hour webinars (for 11 Saturdays) that will help you focus on the technical skills and specific things that you have always wanted to know about in order to grow your business. We have come up with 10 sessions with 11 expert lecturers (with 1 FREE session if you enroll in the full program) that will make you a stronger and better entrepreneur. Register here to join the Enter Entrepreneurship Webinar Program now!

P.S. 5. Learn How To Make Money From Foreclosed Properties! We are on our 3rd run of the Usapang Foreclosed Property Investing with Jay Castillo of ForeclosurePhilippines.com! Happening on September 26, 2015 at the SMX Aura, Bonifacio Global City. Click here to register and avail the early bird promo!

P.S. 2. We just opened up the enrollment for our “Money Tree System“ online program. Read the entire letter as this is a limited opportunity. Remember, the enrollment is open until this Friday, August 29 only. So you better act now if you want to join the “New Rich”. Click here to reserve your spot.

P.S. 2. For those who based in Manila, you may attend our FREE Biblical finance seminar on July 27, 2013 at the Rufino Towers, Makati City. Keep posted here for details.

hi i want to know more about COL EIP.

Hello Edralyn. Thanks for inquiring about COL EIP. Have you gone through the article?

Basically, once you have submitted your application to COL, relevant details will be sent to you regarding funding and scheduling of your EIP stocks.

What particularly do you want to know about the EIP?

Hi Burn! Thanks for the info. I’m thinking of opening an account this week. So with the initial fund of P5,000, flexible na ba iyon in buying stocks sa different companies? Like for example, maglagay ako ng P2,500 kay A at P2,500 kay B, is it possible? And how much ang minimum investment sa mapipili kong company? Thank you.

By the way, this article is very useful. Inintroduce ko kasi ‘to sister ko kanina lang, I showed her Pesos and Sense’s Youtube video, and super interested sya, at and tanong niya agad sa akin ay paano sumali. Until she decided to have mom open her acct with EIP, then saka nalang sya mag-oopen ng sa kanya pagdating niya dito sa November. I’ll share this to her, so at least she’ll know what to do. 🙂 Thanks again, Burn. ^^

Hello Angel! Congrats to you and your sister for deciding this early to invest!

That depends on the price of stocks that you’re gonna buy. For example, you can BPI shares for around P1,000 these days for the minimum required shares to buy. The same thing with Jollibee. Other companies like Ayala Land can be bought at around P2,500 for the minimum shares required for buying. So you will still have a few pesos left from your P5,000, so to speak. Just leave it there in your portfolio’s “cash balance” to be added up to your next month’s investment. Hope to help you more. Just keep on posting your comments so that I could guide you further.

Thank you very much for following my blog. God bless you and your family! 🙂

Orayti! Thanks, Burn! Big help it is! 🙂

I saw one of the comments in Pesos and Sesnse’s blog about Peso

Cost Averaging that there’s a trial account thing, I think it was from you (not sure though). I’ll try it for now. I’ll let you know if I have questions soon. Hehe.

Tee why! 😉 God bless you too and your household.

My pleasure to help you on your investing journey, Angel. Have you opened an account with COL yet?

hi Mr. Burn,

im really wanted to invest and i want the COL Plus but still not cleared for me, they are the one to recommend which is the right company to join and buy shares? or do i need to go on their office to verify with my self? @ COL Financial Business Center

24th flr. East Tower, Philippine Stock Exchange Centre,

Exchange Road, Ortigas Center, Pasig City

1605 Philippines.

Could u pls help me to get through, all the requirements and application to be needed.

is this long terms of investment or any time, any months, in a year u can pull-out your shares?

Hi Antonio! Are you based overseas? Even if you are in the Philippines, you may send the application forms to them without going to their office. Kindly read my blog post again. All the requirements are indicated above.

Investing should always mean long-term. But you can withdraw anytime should find it not beneficial for you, which is impossible. 🙂

hi burn,

first of all i’d like to thank you for your very helpful blog.

i just like to ask if the Php5,000 same as the php25,000 initial deposit

will be your maintaining balance each month like the bank deposit maintaining

balance? sorry for noooobie question 😉

thanks in advance!

Hi! Don’t worry, you’ll soon be part of the 1% investing Filipino population. 🙂 And thank you as well for visiting my blog.

The P5,000 and P25,000 are just initial investing amount required by stockbrokers as mandated by law. Investing in stocks, mutual funds, UITF’s, etc. require no monthly maintaining balance (or topping up) as these are not deposit/bank products. You have total control of your portfolio after your initial investment.

hi!can you tell how to open an account even if I’m here abroad? may i know your e-mail add if you don’t mind.

regards,

Ireneo, I mentioned all the procedures in my article above. Kindly re-read all over. You can download the forms through the links above as well.

PSE Academy (www.pseacademy.com.ph) provides a comprehensive, interactive, and practical web-based investor education for market participants, would-be equity investors, and the public in general.

Hi! Sorry for the naive question but can the billing statement be named to someone else?

Yes, no problem with that. When you submit the scanned copies to the Helpdesk, just mention that you really reside in that address.

Yes, no problem with that. When you submit the scanned copies to the Helpdesk, just mention that you really reside in that address.

Hello Burn, I read thoroughly available information regarding EIP. I am working in Kuwait and i want to grasp first hand clarity how possible it is to engage in TRADING ONLINE (while in Kuwait). I really want to attend the free seminar but as i said am currently working in kuwait and my annual leave will be on february(2014). Hoping COL would provide downloadable “EIP seminarCoverage” after joining confirmation.

Noel, EIP is COL’s program to provide affordable investing venue for Filipinos everywhere. The concept is that you buy shares of companies, let;s say worth P5,000 on a monthly basis. You can already buy Jollibee and BDO shares with that amount every month. You just keep on buying every month for the next 10 to 20 years. Do it for your retirement or for the education of your children. It’s that simple. I can help you open an account even if you are still there in Kuwait.

This episode of Pesos and Sense may help you give further information about investing through COL: https://www.youtube.com/watch?v=i4Mqy7U9dhQ

Let me know if you have more questions.

Thanks Burn, my family will now tour Pesos and Sense episodes. Somehow, pls comment where can i find the whole current Traders Code? At the moment im just waiting for my BDO account detail in appx45 days, then i will hit PSE Line, thanks to You and COL in advance.

P.S. pls verify OSTA no.13 regarding investment advice from COLPlus account priviliges.

Ill keep in touch. Best regards.

I’m not sure what you mean by Traders Code.

You don’t need to have a bank account in order to start investing in stocks. And you can choose COL Start instead of COL Plus.

No. 13 terms/conditions simply state COL limitations and responsibilities as a broker and not as an advisor. They can only guide us but not provide professional advice.

Hi burn! Im an ofw and i invested in stock market.what if something happened to me who will benefit my earnings if ever?since wala namang na mention doon kung sino ang beneficiary ko in case may mangyari sa akin.ano po ba gagawin ko.thank u burn and God bless u always.

Totie, maganda i-discuss mo yan sa spouse mo (kung married ka na) or sa mga magulang/kapatid mo na meron kang investment. Dahil madami silang dapat na asikasuhin. Importante na meron kang insurance or extra money para pambayad ng estate/transfer tax. Para mas malinawan ka, visit mo ang blog post ko tungkol dyan: http://burngutierrez.com/what-happens-to-your-stocks-if-you-die/

hi sir hiwalay po ako sa asawa gusto kong makajoin to buy share ok lang po ba yun sa ph5,000 ofw po ako, starting na po ba yun 5,000

Oo, Joselito. Starting ang P5,000, maibibili mo na yung ng minimum shares ng dalawa hanggang 3 companies. Tapos sa mga susunod na buwan nasa yo na kung magkano ang iinvest mo. Pero advisable na at least 20% ng sweldo mo ay iinvest mo for your retirement.

panu po magiging member ng COL sir

Hi Allan, isang stockbroker ang COL. Kung gusto mo maging part-owner ng mga publicly-listed companies sa Pilipinas gaya ng Jollibee, PLDT, SM, etc., kailangan may account ka sa isang stockbroker gaya ng COL. Sundin mo lang yung mga steps sa article kung paano ka makakapag-open ng account sa COL.

Hello! Your blog is so interesting & helpful. Im planning to invest but i dont know how, please advise. Tnx & God bless!

Hi Bechay, join us at OFW UsapangPis FB Group: https://www.facebook.com/groups/OFWusapangpiso/ or email me burngutierrezblog@gmail.com

Hi! Okay lang ba kung gagawin daily or sabihin na natin twice a week yung pagbili ng stock?

If you are doing this for the long-term, meaning wala ka pang balak magbenta in the next few months or years, then I suggest you buy once a month lang.

Hi Burn! Thanks for the very useful info. For the 25k initial investment, kailangan ba everymonth din 25k or depende sakin and sa budget ko? Say next month i have 10k and then the following month 5k. Pwede ba un ganyan sa Col eip? Or better yet go for the 5k initial?

Another thing, i used to have tin number and sss number when i was working sa Pinas which is req’d in filling up the app form kay Col. but when i started working abroad, wala na ako idea sa tin and sss number ko. Paano ang gagawin jan? Kasi even my wife wala na rin sya idea sa tin nya since she stopped working a few years back. Any suggestion? Thanks in advance for your time.

Hi Aj. Hindi kailangan na 25k din sa succeeding months. Depende yan sa mgiging monthly budget mo for investing. Pwedeng COL EIP/Starter na lang muna ang i-open mo dahil reports and analysis lang naman ang pagkakaiba nung 25k and 5k starting accounts.

Yung SSS and TIN, pwedeng to follow na lang. Pakiusapan na lang ang COL. But I suggest na hanapin ninyo ang TIN and SSS nyo for future use. Pwede yan itanong sa former employers ninyo or sa SSS mismo.

Hi Burn. Thanks ulet ng madami! More power!

magandang gabi po. Tanung ko lng po kung pwd po ung kabayan acount ng bdo

Hi Sir Burn, Thank you very much for your prompt response. I really appreciate it. I will do the procedures that i’ve seen on the link on how to open an account to COL. Hoping for your continuing guidance for investing. More power!

I’m living in the US with my American husband. Can we both invest in the Philippines or just me?

Which one is better? Cost averaging ? Buy and hold? or Day stock trading..

hi Burn, pwede ko ba pondohan ang aking magiging COL aCcount through remittance centers? NAsa UAE ako wala akong ol bank account. thank you

Hi Jennifer, pwede via remittance centers.

To fund your COL account, remit to COL’s BDO account: https://www.colfinancial.com/ape/Final2/home/pdfs/fund-overseas-bdo.pdf

To fund your account via iRemit: https://www.colfinancial.com/ape/Final2/home/pdfs/iRemit%20Overseas%20Remittance.pdf

Hello again sir. You mentioned about protecting ourselves and family with life insurance and 6-Month worth of cash savings for emergency fund…

I would like to hear your advice po kung saan best makakakuha nito.. Thank you again.

Sa life insurance, pumili ka sa top 5 o top 10 insurance companies sa Pilipinas. Makikita mo sila dito: http://www.insurance.gov.ph/htm/..%5C_@dmin%5Cupload%5Cstatistics%5CFinal_Ranking_Life_NetPremium2013.pdf

Hingi ka ng appointment sa kanilang agents at pag-aralan mo mabuti at ikumpara ang bawat isa bago ka magdecide kung alin life insurance product ang kukunin mo.

Sa emergency fund, ikaw ang mag-iipon nito. Pwede mo umpisahan na pagipunan sa 3 months na emergency fund. Magtabi ka ng kahit 10% ng sweldo mo hanggang mabuo mo ang 3 months na fund.

Bakit kaya wala pa silang reply sa pinadala kong application sa col via email?

hi dito po ako s jeddah nagwowork ngaun and interested po ako bout s col but the problem is i don’t have a TIN number, moron po b kayong bang way to get a tin number habang nasa abroad ako, thanks

Ser paano po mag apply sa broker n col financial andto po ako sa abroad ngaun.pwede po ba dyan savings account ang gamitin ng metrobank.salamat po

Greetings sir! In opening a col account sir,isa sa mga requirements po doon eh yung bill..ask q lang po kung pwede po bang gamitin kahit bill ng kuryente na nakapangalan sa parents? kung sakali po ba pwede kong gamitin ang bdo kabayan savings account to fund my investment thru col sir? Salamat po.

Hi Vilma. Yes, pwede ang billing statement na nakapangalan sa magulang mo. Yung online banking ng BDO mo pwedeng pwede na gamitin sa funding mo ng investment sa COL. Bibigyan ka naman ng instructions ng customer officer mo sa COL later on. Good luck!

(Note: OFW’s may submit their credit card or bank statements in their country of work. Just make sure that the address you wrote on the forms and signature cards is the same as the address indicated in the credit card statement.) BILANG OFW PO HINDI PO AKO NAG OPEN NG BANK ACCOUNT SA ABROAD, REQUIRED PA RIN PO BA ITO SA MGA WALANG BANK ACCOUNT SA ABROAD NA GUSTONG MAG APPLY SA COL FINANCIAL PHILIPPINES?

Hi Simplicio, kailangan mo lang na may bank account ka sa Pilipinas. Ano ang bangko mo?

Thanks Sir Bum, BDO po bangko ko sa Pinas.

Hi Sir burn,

magandang araw po may sked po ba kau sa Dec. for seminar para sa investing?

Hi Roger. Saan ka based? Meron sked sa December pero hindi pa confirmed ang dates. Meron din webinar/online seminar before Christmas.

Hi Sir.seabased po ako onboard ngaun!ang bakasyun ko by Dec.mga 2nd week mas gusto ko kasi personal ako mka attend para maintindihan ko ng maayus.,nkapag try n din po ako ng webinar kaso nkkulangan pa ako.,salamat sir

I’m interested but I don’t know about this