What happens to your stocks when you die?

They’ll get stuck. Just kidding. 😉

Some of my colleagues and forum members were asking me this question as I was promoting to them the benefits of investing in the stock market. I know. This should have been written last month during Halloween.

But seriously, this is one question that any investor should not be ashamed to ask. As a matter of fact, this should really be discussed by any investing family person with his or her family members and loved ones even during ordinary days. And with disasters such as the recent typhoon, we really need to be ready.

Someone from your family must know the things to do when you die. One of these is taking care of your estate.

“Will My Stocks Go To My Family When I Die?”

One of my colleagues who opened his first stock investment account asked me this. He said he could not remember writing down the names of his wife and children on the account information form during his application. He’s worried that the stockbroker will not honor his family members as his beneficiaries should they apply to withdraw the proceeds of his stocks upon his death.

That was a valid question. And that will help him plan out his wealth for future distribution to his spouse and children.

I’m not a lawyer nor have I focused my career that much on estate planning and wealth management. But I have encountered a client years ago who was trying to solve a problem on the inheritance among her siblings that her father did not plan out when he was still stronger and mentally capable. The siblings tried to kill each other over a wealth that a father failed to write down on a will. You’ve seen that in the movies. Well, it’s happening in real life.

Going back to my colleague’s question, my answer is, Yes.

However, it would not be that easy for his heirs. His shares in a Philippine company is considered taxable. Before his bereaved family members can claim all of his stocks, they have to pay the “estate tax”.

While he’s still alive, he should either consider looking for a professional administrator, a lawyer, or an estate planner. This estate planner will assist his family in settling all his estate including his stocks in court. For sure it will cost him or his family thousands of bucks for acquiring such services. But what is a professional fee if he’s got 8 to 9 digits in his assets left to his family and everything will be taken care of?

He has to make everything convenient for the loved ones that he will leave. Including assigning someone who will take care of his estate tax.

Note: (Estate pertains not only to investments but all your assets such as your house and lot, condo units, cars, cash savings and time deposit accounts, franchises, businesses, farm lots, poultry/animals/pets, equipment, furniture, etc.)

What is Estate Tax?

The Bureau of Internal Revenue (BIR) defines estate tax as:

…..tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are made by law as equivalent to testamentary disposition. It is not a tax on property. It is a tax imposed on the privilege of transmitting property upon the death of the owner. The Estate Tax is based on the laws in force at the time of death notwithstanding the postponement of the actual possession or enjoyment of the estate by the beneficiary.

Are stocks or shares in a company really considered as part of estate? Yes.

The BIR also classifies the following as part of gross estate:

– Shares, obligations or bonds issued by corporations organized or constituted in the Philippines

– Shares, obligations or bonds issued by a foreign corporation 85% of the business of which is located in the Philippines

– Shares, obligations or bonds issued by a foreign corporation if such shares, obligations or bonds have acquired a business situs in the Philippines ( i. e. they are used in the furtherance of its business in the Philippines)

– Shares, rights in any partnership, business or industry established in the Philippines

Note: Check with your respective stockbrokers on how your heirs/beneficiaries will claim your stock proceeds from them in case of your demise.

**UPDATE FROM COL FINANCIAL:

DOCUMENTS TO BE SUBMITTED BY SURVIVING SPOUSE IN CASE CLIENT IS DECEASED.

- Deed of Extra-Judicial Settlement of Estate with Affidavit of Self-Adjudication

- Proof of filing of the Deed with the Registry of Deeds where estate is located. (stamp at the back of #1).

- Proof of publication with Affidavit of Publication of the Deed of Extra-Judicial Settlement.

- Proof of payment of estate tax with tax clearance.

- Certificate of Marriage between spouses duly issued bye the National Statistics Office (NSO).

- Certificate of Death of client.

- Proof of identification of client and surviving spouse.

Surviving spouse may then open an account with us to transfer all stock and cash positions from the deceased client’s account to the surviving spouse’s account. Surviving spouse will have to submit identification documents and POB and accomplish account opening forms.

How Much is the Estate Tax on Your Stocks?

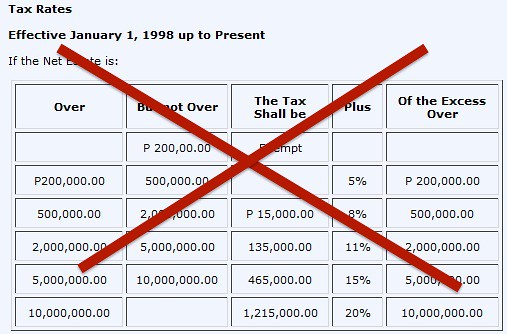

The new TRAIN law of the Tax Reform for Acceleration and Inclusion has repealed or cancelled the old estate tax rate table below.

So beginning 2018, those who will inherit properties and assets from a deceased person will have to pay an estate tax with a flat rate 6% on the amount in excess of Php5,000,000.

Good news for those who leave a fortune amounting to less than Php5million.

So to answer our question, for example you have Php12,000,000 worth of stocks/estate upon your demise (less standard deduction of Php5,000,000), your net estate will be Php7,000,000.

To illustrate;

Php12million – Php5million = P7million (net estate)

Php7million x 6% new estate tax rate = Php420,000 (estate tax due)

Note: Again, this is just an illustration. The BIR will still consider your gross assets (in other words, your total fortunes, minus allowable deductions) before coming up with the actual estate tax figure based on the new flat rate of 6%.

Are you certain your spouse or any of your family member has Php420,000 worth of cash on hand to pay all the estate taxes when you die? Better plan things out. Or your family members will not be able to claim that Php12Million soon.

This is where your life insurance will matter most.

Why Do You Need A Life Insurance?

When you buy a life insurance you will be required to fill out and appoint the name/s of your beneficiaries. When you die, that family member such as your spouse, legal-age children, siblings, or parents (tough oldies, huh?) will have the right to claim your insurance proceeds.

The insurance proceeds can be used then to pay off the estate tax dues. Your family will surely cry tears of joy in gratitude for buying a life insurance. They will then have the money to pay for your estate taxes and therefore claim all your stock proceeds.

Check your insurance policy and see if it can cover your future estate taxes.

Advice: Consult with your trusted insurance broker/financial advisor on how to determine the right amount of insurance to protect your investment and to give financial security for your family.

What Are the Requirements and Procedures to File an Estate Tax Return?

If you are not getting the services of a lawyer or an estate planner, you should discuss with your spouse the distribution of your wealth among your children. Of course, don’t forget your spouse’s share of the pie. 😉 [Extrajudicial Settlement of Estate]

More importantly, discuss with your spouse the procedures on filing the estate tax return. It will be very tedious but it would be helpful for your other half to manage the things to do when this sad part of your journey comes.

I suggest that you visit the BIR website to know the details on Filing an Estate Tax Return. Or better yet, ask for the services of your CPA or lawyer friend.

Receive posts like this by subscribing to RockToRiches|burngutierrez.com for free.

Rock your way to abundance!

P.S. Thanks for the inputs of Mr. Stocks Smarts, Marvin Germo, Aya Laraya of Pesos and Sense, and Mitch Bacani of COL Financial.

—

If you want me to coach you in improving your finances, type your name and email below and click the Subscribe button:

sir tanong ko lang. I’m an OFW base in Singapore. Nag invest ako primarily in Index Fund ETFs(from vanguard) which are U.S. based using a Singapore Broker (Standard Chartered Bank). Do my beneficiaries need to pay estate tax when I die to

1. U.S. Government – Since my Index Fund ETFs (Vanguard.com) are incorporated in U.S.

2. Singapore Government – SInce my broker is a Singapore base company (Standard Chartered Bank of Singapore)

3. Philippine Government – Since I’am a Filipino Citizen

My take on this is that although Vanguard is a US entity, the transactions were between you and your broker which is Standard Chartered Singapore. Your beneficiaries shall only be communicating with your broker for the transfer of your estates to them. But as far as I remember, estate taxation in Singapore was already abolished. Better check with your broker’s legal department for the claim procedures so that your heirs will know what to do in case of your demise.

As a non-resident Filipino citizen, you will only be paying for taxes on income sourced in the Philippines. Your gross estates should only include properties (including tangible ones such as proceeds from sale of stocks) located in the Philippines.

Thanks Burn. Yeah, I check from IRAS that we do not have to pay Estate Tax and that it was already abolised http://www.iras.gov.sg/irasHome/page.aspx?id=778

This is such a good news. I was thinking to keep my shares here in Singapore since it’s more costs effective in terms of taxes.

I recommend that you check with a legal consultant there in Singapore, preferably a Filipino, on how to transfer your assets there to your family’s account in the Philippines. I believe there are certain limitations and that it will need some kind of clearance from the Singaporean government before your heirs can claim the estates.

Yes Burn, me and my wife is already looking into this. We area already seeking consultant here in Singapore.

Another thing I want to ask is about my setting up a will. Since my assets are here in Singapore (in U.S. Index Fund ETFs), do i need to have a separate will created here in Singapore? If let’s say I move to Australia, do I need to have a separate will in Australia say I will have assets bought there?

My suggestion is, yes. Every state or territory has its own laws of intestacy.

The answer is no. Regardless where you are residing there should only be 1 will that shall be probated…the earlier ones are deemed cancelled. Please note also that intestacy = no will; if there is, then it is testate.

Thanks for this useful post! Tanong lang: is Fair Value refers to amount investment only and not included earning?

Should include both. Pero kung ano ang magiging interpretasyon ng BIR sa Fair Value, yun na yun 🙂

May nilabas kase ang BIR na bagong revenue regulation, RR 06-2013 “prescribing the use of the Adjusted Net Asset Method whereby all assets and liabilities are adjusted to fair market values. The net of adjusted assets minus the liability values is the indicated value of the equity.”

Sir I have a question. I am 24 years old and I dont have a spouse. Can I leave my stock investments to my sisters and my parents? Considering that my stock does not exceed P200,000, so they wont need to pay the estate tax, would they sill need to submit the requirements you posted? Would they need a lwayer to get those seemingly cmplicated forms and papers? Thank you so much,. I really need this.

Your heirs don’t necessarily need to get a lawyer to submit the requirements and claim the proceeds. If your total equity fair value at P200,000 or below at the time of your death (or BIR’s fair value assessment), then your heirs don’t have to pay the estate tax. They still need to file all those documents though as required by law and by your stockbroker/fund company.

Hello sir, about this paragraph:

“Are you certain your spouse or any of your family member has Php1,615,000 worth of cash on hand to pay all the estate taxes when you die? Better plan things out. Or your family members will not be able to claim that Php12Million soon.”

Pwede ba ibawas na lang yung estate tax sa makukuha ng heirs kung sakali wala pambayad?

That doesn’t work that way with the BIR I believe.

BIR only accepts Cash or Managers check .

Hindi ba pwede mangutang sa iba. sure naman na mababayaran mo sila pag nakuha na yung stocks. you just need lawyers para walang salisihan. Ang weird kasi baket hindi nalang pwedeng illiquidate yun stocks to cash tapos ibigay yung part ng BIR.

Hi Burn…

Nice article..

COL application has a secondary name or applicant right? Is it possible to place the name of the child or heir…even at a minor age? Say 11 years old.

Thanks in Advance

JET B

Hi Jet, you can open an ITF (in-trust-for) account for your child with you as the primary account holder. But technically, the account will still be under your name and you still own the stocks in that account. It will only be transferred to your child’s name upon your death or upon reaching the legal age of 18 but will still be subject to transfer taxes.

Hi Burn

when you say “transfer tax” on your reply…does it mean the same thing with “real estate” tax that you have mentioned on the article right? or there is another computation since the kid is under the secondary name holder of the account?

thanks a lot in advance and more power!

JET B

am sorry….”estate tax” and not “real estate” 🙁

Hi Burn,

just to re-iterate my inquiry.

You mention or suggest ITF, but my scenario is like this.

COL Application has Name1/Name2, Primary/Secondary Account Holder respectively. Right? Name1 died. Does Name2 inherit or assume the accounts ownership.

or its just the same scenario as you have presented earlier as ITF?

If that is the case, why did COL (or perhaps any broker for that matter) put Secondary Account Holder on the application form and not automatically an ITF option.

Thanks a lot.

JET B

hi sir, what if iyung stocks na binibili ko ngayon ay naka-itf (in trust for) sa pangalan ng anak ko?, kailangan pa rin ba ng estate tax?

@mitch, kailangan pa rin ng transfer tax dahil ikaw pa rin technically ang may-ari ng stocks.

thanks burn for taking the time to answer my query

any change in ownership requires transfer taxes, whether its donor’s tax or capital gains tax

just like to ask, why can’t you assign anyone as beneficiary? how come you can’t choose who your beneficiary will be?

Because the BIR said so. 😀 Seriously, your stock investment should and will always be part of your “estate” and are can not be transferred o another name or beneficiary if you want to. You another have to “donate” it and pay “donor’s tax” when you’re still alive, or “transfer” it to your beneficiary and have them pay “inheritance/transfer tax” when you die. All your other “estates” or pag-aari will be assessed by your friendly BIR neighbor. Whatever comes out, you or your loved ones pay.

Hi Sir Burn, just a question, is owning a Mutual Fund also taxable to estate tax? I really like your article. Thanks in advance…

Hi Allan. When the mutual fund investor dies, the mutual fund will form part of his estate and therefore subject to estate tax.

Hi Burn. Yung samin ni misis is a joint account. Kapag mamatay isa samin pwede ba liquidate yung half free of tax then bayaran yung estate tax ng remaining half? All of our properties including stocks are joint account.thanks.

Hello po, tanong ko Lang po Kung anong pwedeng gawin kasi matagal na pong namatay lolo ko at may hawak pong 5 stock certificate ang father ko na pag mamas-ari ng lolo ko and existing naman lahat ng company. Possible po ba na may makuha silang pera sa company or pwede run ibenta? Salamat po

Hi sir! I am following your blog and fb fan page. Thanks for all the informative posts about stocks and investing. Anyways, I have col acct for 5years now but was only active for 2years… I do log-in and check my port once in a while. I’m planning to be active again after 3years of hiatus…Tanong ko lang and just want to make sure na pwede ko pang balikan yung EIP col acct ko ngayon? Lifetime naman po ang membership right? Kahit 3years ako hindi active?

Hope to hear from you. Thanks sir!

Hi Jescel. Yes, account mo naman yun for lifetime. Try logging in now.

What if yong family nya alam yong login details nya sa colfinancial for instance. Diba pwede nilang i withdraw doon direct to the account owner bank account?

If this is the case need parin ba yong mga details na ni rerequire ng colfinancial?

Hindi naman COL Financial ang may requirement nyan, kundi ang government agencies like BIR. Kapag hindi nai-file ang required documents sa BIR pagkamatay ng accountholder, mag-aaccumulate ang penalties at ang dependents din ang maaapektuhan.

Can you kindly update the estate tax rates base on TRAIN Law. 😀

So, can we say na if your total assets is less than 5 million, the transfer will be a breeze? If ganun nga, what is the process for transfer sa house or car?

Thanks.