For most OFW’s (and Filipinos as a whole), owning a land or a house is like winning a championship trophy in a basketball game. In fact, that’s an understatement. For the working Filipino, it is an achievement and a dream-come-true to finally own a tangible “investment”.

But if you are someone who has just started working, being tempted to “invest” in a house or lot somewhere outside the Metro or in a condo unit somewhere at The Fort is rather inevitable.

You can not escape from the binoculars of real estate agents positioned strategically inside malls and commercial establishments. They can identify if you have been dreaming to have a house soon. They know if you’re an OFW or a newbie yuppie from Makati.

Investing in A House or Condo Is Expensive

Flyers from property agents are results of great marketing efforts. They can really attract would-be buyers and potential “investors” to put in their hard-earned salaries and savings in house, lot, or condo unit. But buying a house or a condo unit isn’t cheap. You have to shell out at least 10% of the total contract price or value of the unit that you are dreaming to buy.

If you don’t have cash on hand, you will end up applying for a housing loan just because you believe that buying a house is an investment for you. And when you buy a unit on installment basis, you end up paying double the actual value of the that unit that you’re planning to have.

I know a lot of people who dipped their hands and feet into buying a house and lot without enough cash or other income streams to back up their plans of turning the unit into an income-generating asset. As a matter of fact, most of them didn’t have plans from the start. Those properties are now owned and being sold by the bank. Foreclosed for failure to commit the monthly amortization.

While buying a property may guarantee you price appreciation and capital growth, this is not always the case. “Investing” in property may not also give you the returns that you were expecting when the agent first offered you that Php8,000 per month amortization.

It’s very important that you make your personal assessment first if you really need to buy a house or a condo unit now before signing that contract and applying for that housing loan in the bank.

Do you really need to buy a house (investing) for it to generate rental income? Or is it just ego that’s running in your system telling you to buy it now (that’s purchasing, not investing) to show off your peers and relatives?

The Hidden Cost of Buying a House or a Condo Unit

When a real estate agent hands you a flyer in a mall showing you a “very affordable” condo unit in Makati or Libis, just take the flyer and tell him/her that you will think about it first. If he insists to get your mobile number, give them the mobile number of the person that you really hate. Just kidding. 😉

It’s fine to give them your mobile number. But be ready to be invited by them via SMS every hour of the day. Anyway, there’s always free lunch or snacks at the “Open House”. 😀

But in case you are not aware, there are so many other costs to consider when purchasing or investing in a property other than your monthly amortization. Although these costs may vary on a per case basis, still you have to be aware and prepare. See below:

1) Withholding taxes

2) Documentary stamp taxes – 1.5% of Selling Price or Zonal Value whichever is higher

3) Deed of sale preparation – Property Transfer – 1.5% of property value, including PHP100 notarization fee

4) VAT or Value-added tax (If house or condo unit price is above PhpP3,199,200 or if the residential lot is P1,919,000)

5) Local transfer taxes (from from 0.25% to 0.75% of the purchase price, zonal value, or TD value of the property, whichever is higher.)

6) Transfer of title processing fees

7) Registration fees (at the Register of Deeds – Php8,796 for the first P1,700,000 + Php90 for every Php20,000 or fraction thereof in excess of Php1,700,000)

8) Move in fees for new condo

9) Association dues (Php40 to Php75 per floor area)

10) Membership dues (varies)

11) Utility charges (common)

12) Parking slots are not free and you have to buy a slot separately. It has a separate title, in case you are not aware

13) Insurance premium for your unit

14) Insurance premium for common areas and facilities

15) Repairs and maintenance fees (common)

16) Annual real property tax

17) Home inspection fees

18) Other incidental charges

This does not include the huge estate taxes that your heirs will pay for in case you die. Yes, you will die. All of us will, but not too soon. So you have think about insuring yourself as well to at least cover the cost of transferring your estates to your loved ones.

If you intend to sell your unit afterwards you also have to pay for the capital gains tax equivalent to 6% of the selling price on the Deed of Sale or the zonal value, whichever is higher. Consider also paying for your agent/broker’s commission.

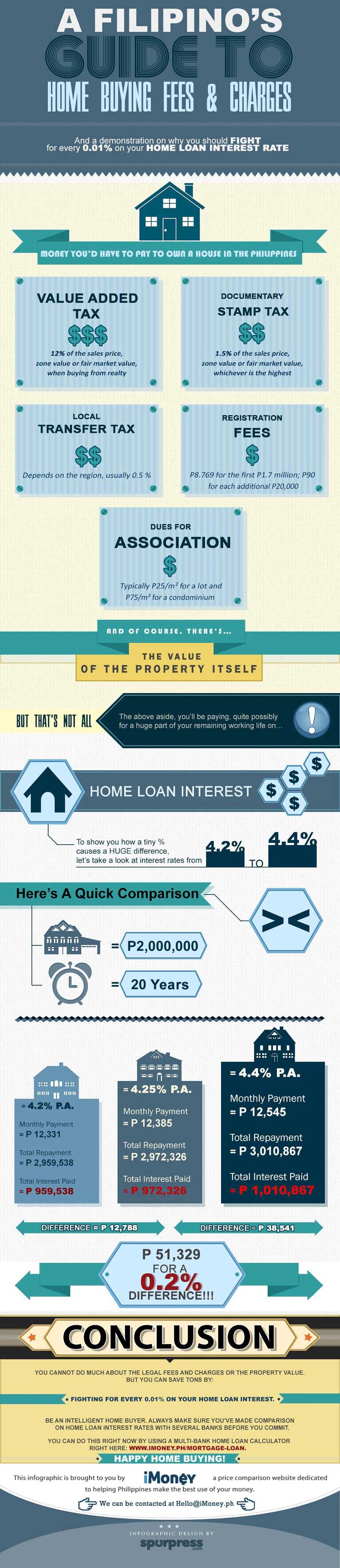

UPDATE: A Filipino’s Home Buying Guide to Fees and Charges [Infographic]

Continue to receive more information and facts about real estate investing by subscribing to Rock To Riches for FREE.

Rock your way to abundance!

#moneyliferocknroll

Great post!

Very informative – and comprehensive! A friend of mine actually got suckered in by such marketing talk. But when she committed, alas she couldn’t afford all the fees and whatnot that they never told her about. Now the condo either defaulted back to the developer or is owned by a bank, and she practically burned a huge chunk of money.

Hi! It’s sad to hear stories about people losing their dream of owning their own property just like what happened to your friend. There’s nothing wrong actually with owning a house or condo as long as you have the capacity and resources to pay for it.

On the other hand, investing in foreclosed properties may not require that you shell out money from your own pocket. You just have to learn how to do it from people who have successfully done it from the past.

Let’s hope everyone would learn how to invest in real estate/property wisely.

Thanks for the info man! So informative indeed!

Hi Kim! Thanks as well for visiting my blog. Buying a house or a condo is good if you just know how to do it or if you have to cash flow to sustain your acquisition of it. We just need to know the basics of acquiring one first before diving in.

Good sir. Would you recommend a place where I can get information on what to know and to prepare prior to selling a property? Also, what resources can I look at to find foreclosed properties? Thank you for your kind reply.

Hi Warren. You may visit Jay Castillo’s website: http://www.foreclosurephilippines.com/

You can also attend Larry Gamboa’s site on real estate investing: http://www.thinkrichpinoy.com/

And Atty. Perez’: http://www.realttorney.com/2013/01/24/how-does-a-licensed-real-estate-broker-register-with-the-bir/

Great post as always. Pa-add sa FB 🙂

Done, Idol! 😀

very informative bro. thanks for sharing. pa add din sa FB please..thanks..

Informative yet it is biased on presenting on cost of buying a real properties without showing the benefits of it.

Paying monthly amortization of 12,545 from “2M loan @4.4%, term 20yrs” is still better than renting a property of 8k/month with annual increase of 5% per annum given the following assumptions:

all rates are per annum

1. 3.5% average inflation

2. 2% opportunity cost

3. 3% appreciation of the property

4. association dues, maintenance, insurance & amilyar were all considered

5. time value of money if applied on the analysis.

6. you may change the above rates depends on your preference. just please apply conservative accounting.

Buying a property is not bad at all. You just need to calculate properly the cost and benefit that are attached to it.

Oh btw, I am also into stocks. If one is bias on real estate, he would just simply show that stocks has the highest risk among other asset classes (without showing the potential reward on investing into it).

I’m not against buying property. I’m actually into investing and inviting people to become knowledgeable in real estate investing. What I presented are facts for those who are misinformed about the difference between just “buying” and “investing”.

I was inspired to write the article since I have (very) close relatives and friends who bought houses and lost them (foreclosed) when their cash flows were cut off (lost jobs, buried in debts, couldn’t find a renter, etc.). And I’m hoping they’re reading this article.

The purpose of the article is to inform the public that we have to plan first and do our homework before buying a property especially with regard to hidden charges . How many people, most especially OFWs, have been victims of misinformation? The author is not discouraging us to buy a property but telling us to be wiser because we will be spending a lot of money on this. Don’t act like a defensive pessimist.

Yeah, I agree. I felt that the article kinda discourage people from buying a house. It also forgot to mention that the primary reason why people buy houses is to provide security for the family by having a roof over their heads that they can call their own (neither to generate rental income nor to show off to friends and relatives). It is a fact that these days owning a house can be very costly (with the amortization, taxes, association fees and maintenance) that’s why appropriate planning is important. However, after many years of hard work you’ll be able to pay it off eventually. Renting on the other hand, is pouring money down the drain and payment won’t stop for as long as you and your family lives.

I do not discourage people from owning a house. It’s the ultimate dream of many Filipinos. But they just have to be informed on what needs to done first as I mentioned them here: http://burngutierrez.com/are-you-really-ready-to-buy-a-house/

If I may suggest on the context of making a stronger point of buying is more expensive, why not make the interest rate more realistic. 4.4% seems to be very low. At that interest rate, i might even be persuaded to buy one soon. But isn’t it, prevailing interest rates are from 8 to 11%? That would mean your 2M investment if you stagger the payment for 20 years at 10% interest may actually cost 2M in interest. That would mean I actually living in a small space worth 2M while I am actually paying for 4M. Come on, 2M condos are not liveable anyway so the stakes could be higher. 4M condo with 5M interest in 20 years? Even middle class cannot afford this. Unless of course all he dreams about is work everyday and put all he earns to the monthly amortization. Why? Because that is 38k per month. If that is going to be the case. I would just rent a place that is worth 4M in size at 15k per month. The difference of 18k which assumingly is lost to interest per month, i will put into other investment vehicles so that in time, i am hoping this can help me pay for a house outside the metro when I retire. A lot of Filipinos don’t see that. All they see is the 9k monthly at zero interest, in the fliers. Which actually is just the monthly ammort of the downpayment of the condo. Once that’s done, nightmare comes. Where to get the 80% of the condo price. In rush, they end up with in house financing, then you know how the story goes.

Thanks for this informative post sir! Sakto titingin kami ng condo ng finace ko next week pero with this post, eh nalaman ko na baka ndi pala namin kayanin. Kala ko nung una mas makakamura kasi habang wala pang pambili ng bahay at lupa, eto muna ung balak ko then benta na lng pg may pera na. Yun pala, anlaki din ng magagastos. Thanks ulet ng marami sir!

Establish a regular income stream and invest in education about property investing. Walang masama kung bibili ka ng condo, but be equipped first with knowledge and a steady cash flow.

Hi Burn! Thanks for putting our infographic in your website. You are awesome!

And your infographic is awesome as well! Thanks for visiting my site, iMoneyPH! More power to you!

great read! thank you!

Got excited about buying a condo coz of marketing flyers & coaxing salespeople…need to considers pros & cons, if I truly need to. Thanks for the wealth of info. However, I am considering buying a condo because of 1-2-3 times a year we come to the Philippines. We stay at hotels for at least a week. Most of my closest extended family also make Philippines their home for a week to a month, 1-2X a year. Instead of lodging (also because we/they require at least 2 bedroom with full kitchen) @ a hotel, we are seriously thinking about buying a condo….any costs we have bargaining power?

please add as friend on facebook, im funky buddha TY

Wow. Owning such tangible asset in the Philippines does cost a lot. Unfortunately, many OFWs buy the idea of an “investment” without closely examining what they’re getting into. Many of them break the bank, siphon off their retirement savings or end up in debt to be able to own a property. And I do agree that owning a home is so important to us…more often, it’s an emotional purchase which gives us a feeling of success. I’ve written about it in my blog too. Kindly check it out: http://financialrescuellc.com/money-mistakes-to-avoid-during-your-employment-years/.

Cheers!

Great info… Pa add din sa FB thanks.. Bernie

Please include also the fire insurance and mortgage insurance that the bank may require to pay aside from housing loan or the amount to be loaned. These were not informed to me when I get the loan and unfortunately discovered it when I signed already the contract.

These are very helpful tips that everyone must consider before buying a condo. At the end of the day, it is important that you are honest with yourself of how much you can afford so it won’t turn out to be a disaster. For more info on condos at The Fort Taguig Philippines, you may visit http://www.thefortcondominium.com

Thank you, Burn, for laying out the hidden costs of buying either a house or a condo. I agree with you that before you invest in a property, make sure you know all the costs that accompany it.

Wow! This is very informative. As a real estate person myself, honestly, I did not realize how costly it is to buy a new condo. However as a buyer it is very important also to do due diligence before diving into buying properties. Very helpful article. Thanks for this.

In most condo projects that we are offering, most of the fees mentioned are already included in the total contract price of the condo unit. Of course, after turn over of unit, a buyer needs to shoulder association dues (but this can be included in the rent that tenant will pay), real property tax, and turnover fees for electricity, water, etc. These expenses are comparably small against your property appreciation and rental returns. Just buy a condo unit located in a very good location usually near call centers, schools, and CBD.

I think while your intention is not to discourage people from buying properties, the overall tone set by this article appears to be that way. I honestly felt that way when i chanced upon your article…. it certainly felt like a debate might ensue over those investing in paper assets versus those in real estate (I have investments in both).

so while the intention of informing the public is there, the tone might need a bit of fine-tuning 🙂 just my 2 cents’ 🙂

If you take this article too seriously, you may never get a house or a condo or a property. Investing is a risk. You are also in a risk of losing your money even if you are not a investing.

I dont agree calling these costs “hidden”. My agent made me aware of these costs before I purchased my condo in Makati.

Im not sure if you have bought one, but these costs are detailed in the breakdown in the TCP before they make you pay the downpayment.

very helpful and informative article. for anyone looking for a condo, try here

http://www.condominiumphilippines.ph

Thank you for this, If ever you want to invest for real estate properties, very affordable yet convenient and has an easy access through different cities in Metro Manila. Visit http://www.buysmccondo.com.ph. I am in the urge of investing on a condo or real estate. Thank you for this very informative article. It helped me a lot.

Yng iba kasing agent hndi detalyed mag benta pero now a days mostly sinasabi naman nla at detalyado ano ang dapat mong bayaran bago ka mag sign ng agreement.

Mas mabuti na mag monthly ng amortization kay sa mag bayad ng renta na hindi naman mapasayo. If mangutang naman lang ng bahay para sa pamilya e assist muna ang kakayahang financial if kaya ba maka tostos sa monthly nito.

Hi. We invested in a foreclosed property from PAGIBIG. It is a condo unit in Smiles Citihomes. From what I know move in fees are required for NEW units. My question is, does move in fee required for foreclosed properties? I will be waiting for your respond. Thank you.

Maybe investing in condos and house and lot may differ. Though, they may have hidden costs, but compare with condo, there are many cons. This why investing in a house and lot is better. Just in case you may visit this website http://www.pueblodeoro.com/.

That’s is why I stop buying house and lot for rent because in my more or less 10M worth of 2 houses for rent I got about 50K monthly rental only which is 10 years of rental can not return my investment less annual tax.However, better than savings in the bank but if you need your money you can not get your money in a short time unlike investing in stock market 3 days notice only as long as you sell your stocks. Sorry guys what I say is not good for the real property agents.

Nowadays condos are considered to be the trendiest place to live in right now though not practical. If you would ask me, I still a house and lot over a condo. More so if its a molave home. The house is equipped with so much eco-friendly everything saves all kind of thing. To further explanation just visit residence in paranaque

I am an OFW and at the same time property investor at property consultant na rin sa ngayon. Kung nabasa ko ito noon baka 100% maniwala ako sa writer ng article na ito. Honestly, buying a property before was not an option for us and we have zero knowledge in investing into a property especially condo. Naeducate kaming mag-asawa to invest into condo at gawing negosyo instead of buying a house and lot na wala naman titira dahil buong pamilya kami nasa abroad. Sa ngayon we have 2 units na pinapaupahan and generating income and it’s more than enough to cover sa monthly amortization, isama pa ang monthly dues dyan and all. I have few units din ng iba na minamanage ko din for rental. We are planning to get another 1 this year. Nakakatuwa nga eh kahit nasa labas ako ng Pinas nagagawa kong magbusiness ng condo rentals through Airbnb, Booking.com at Agoda.com. Kaya i totally disagree sa mga negative about acquiring a condo na sinasabi dito sa article na indirectly discouraging sa mga tao not to invest sa condo because of this and that. This time, regardless kung magkano ang halaga ng unit namin as long as hindi na sa bulsa namin nanggagagaling ang pambayad, I don’t care. We are looking forward in the future na pagdating ng araw hindi na ako magbabayad ng monthly at full income papasok na sa bulsa namin. Imagine if you have 2-5 properties na kumikita ng let say average 30-50k per month pwede na itong pang paaral ng tatlo kong anak pagdating sa college and we can retire early and go home to Philippines. Sa mga OFW’s na kagaya namin at sa mga kababayan natin na nag-iisip mag-invest sa properties lalo na sa condo ito ang maipapayo ko. First, before buying, check the developer’s track record. Tayong mga OFW hindi natin nakikita ang actual site kaya baka nagbabayad ka ng ilang taon pero hindi pa tumatayo ang building. Second, the location. If you’re purpose is for business make sure maganda ang location mo. Hindi porket mura ok na. Isipin mo papaupahan mo yan at depende sa market na gusto mo. Third, the amenities. Anong meron sa condo na para maattract ang magrerent. Ang condo ngayon hindi lang long term ang pagpapaupa, uso na ngayon ang daily rental na parang hotel type at mas malaki ang kita dito. Kung merong swimming pool lang yan at pagbaba mo daanan na ng jeep or bus eh talo ka na sa kompetisyon. Forth, alamin mo ang mga other charges. May mga developers na ang price kasama na lahat pati VAT at miscellaneous fees. And iba naman malalaman mo nalang ang ibang charges pag nagbabayad ka na. Be wise at hindi ka talo dito. Sinasabi ko ito dahil experience ko at di lang sabi ng iba dyan na hiningan ko ng opinyon. Lastly, kung OFW ka at wala ka pang balak mag for good sa pinas in the next few years at nasa abroad kayo lahat, anong point kung bibili ka ng bahay na walang titira? Mabubulok lang yan at masisira at gagastos ka pa sa maintenance. Put your money into something na maggegenerate ng income. A nice condo is an option.

If you’ve decided to buy a condo, it’s important you understand all the costs involved in addition to the price you’re paying for the property.

When buying a house or condo it is really important that you know hidden costs to avoid mistakes in the future. Great blog by the way. Keep sharing!