You have heard of diploma mills. They sell BAs, MBAs, and PhDs to individuals who want to look more educated than they really are.

Did you know there are also diploma mills that sell fake certifications and designations to financial advisors who use these credentials to deceive you into believing they are financial experts?

Unethical advisors know you do not question the advice of experts. This makes it easy to convince you to buy what they are selling.

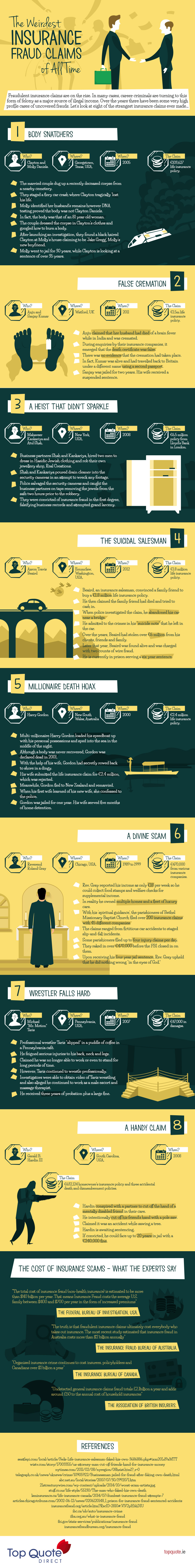

Here are some interesting stats presented in this Infographic.

What are fake credentials?

Real credentials have prerequisites, a comprehensive curriculum, proctored examinations, and continuing education requirements. Fake credentials have none of the above. There are no significant curriculums or meaningful tests. Advisors buy these credentials for a few hundred dollars.

Why use them?

Incompetent, unethical advisors know you want a financial expert helping you plan your future and invest your assets. Fake credentials help bad advisors convince you they are planning and investment experts.

Are they legal?

There are no regulations that require advisors to disclose the work they did to earn their certifications and designations. It is your sole responsibility to validate the quality of their credentials.

Why do they work?

If you are like most investors, unethical advisors know three things about you.

1. Strings of initials after their names (alphabet soup) have a good chance of convincing you they are financial experts.

2. Bad advisors safely assume you do not know what the initials stand-for and what they did to earn them. For example, everyone knows CPA® is Certified Public Accountant. A few people know CFP® is Certified Financial Planner™. But, most people know nothing about the other 250 designations that are used by real and fake financial experts.

3. Unethical advisors know there is a low probability you will take the time to validate the quality of their credentials. Therefore, this is a safe sales tactic that can be used to deceive you into making bad financial decisions that benefit advisors more than they benefit you.

How do I avoid advisors who use this deception?

You can delegate investment work and decision-making to financial advisors, but you are solely responsible for selecting the advisor who does the work and makes the decisions. There is no regulatory agency that will protect from licensed advisors who use deceptive sales tactics.

When you select an advisor there is a free, fast, easy way to check the quality of their credentials. Go to Check a Credential at PaladinRegistry.com to view free reports and quality ratings for more than 250 frequently used certifications and designations.

Do you want to risk selecting an advisor who used deception to gain control of your assets? A few minutes now can help you avoid making a huge financial mistake that could haunt you for the rest of your life.

Source: Jack Waymire, Investor Watchdog, Paladin Registry

Avoid financial scams and be updated about the latest frauds by subscribing to Rock To Riches for FREE.

Rock your way to abundance!

#moneyliferocknroll

P.S. 1. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

P.S. 3. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. You may grab your copy at your favorite National Bookstore and Powerbooks outlets. Or you can grab your copy yourself at ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 4. Yes, our Cyberpreneur Philippines book is now out in bookstores! Check out the chapters from my fellow authors Ray Calbay, Fitz Villafuerte, Ginger Arboleda, Kristel Silang, Marv de Leon, Paolo Lising, Anne Quintos, and other great online entrepreneurs and experts! Score your copy here now!

P.S. 5. Send healthcare and grocery products online to your loved ones in the Philippines via BeamandGo!