Are you an OFW who’s been looking for an investment placement where your money could grow higher than your time deposit account?

Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out?

Fret no more.

I have partnered with some of the country’s top mutual fund companies and I can help you out start your journey to financial freedom by opening an account with any of them.

How Can I Make Millions in Mutual Funds?

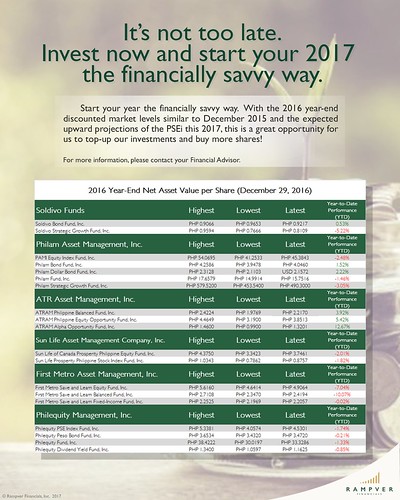

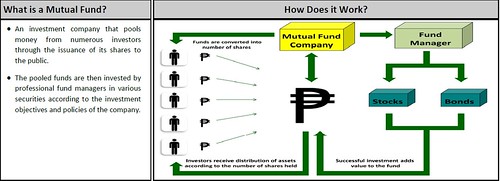

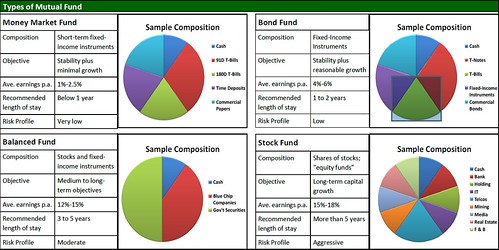

Mutual funds are invested in stocks listed on the stock exchange as well as bonds issued by the government and corporations where values differ daily. As a result, the value of your investment fluctuates daily depending on the performance of its underlying instruments. Funds’ earnings are not fixed but are very flexible, at an average of 6-18% a year. Over the long run, mutual funds usually outperform traditional time deposit placements or short-term money-market funds.

I Am Already Investing in Stocks and other Businesses. Do I Still Need Mutual Funds?

Diversify your investments by adding mutual funds to your portfolio. In times when the stock market is down or your business is not in its top form, your mutual funds will still work on its own to achieve your financial goals.

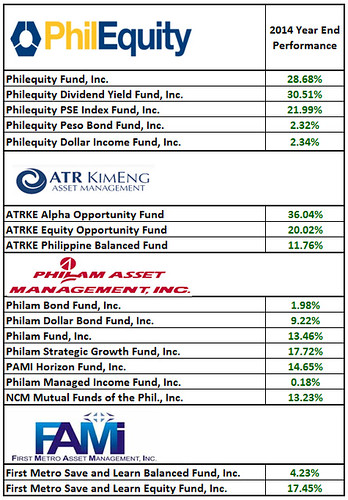

The numbers/percentages you are seeing below are what your money would have gained if you invested on any of these mutual funds at the beginning of 2014 and redeemed by December of the same year.

How To Open a Mutual Fund Account for OFWs or for those outside Metro Manila?

1) Download and fill out the forms of your chosen mutual funds.

To apply for a FAMI mutual fund account, click here to download forms.

To apply for a Philam mutual fund account, click here to download forms.

To apply for a Philequity mutual fund account, click here to download forms.

To apply for an ATR Kim Eng mutual fund account, click here to download forms.

To apply for a Soldivo mutual fund account, click here to download forms.

And now you can apply for a SUNLIFE mutual fund account. Click here to download forms.

Should these links fail, please email me at burngutierrezblog@gmail.com so I could directly send you the forms.

2) Scan or take pictures of the filled out forms for verification. You may email them to me for checking.

3) Send by courier the originally-signed documents for initial investments to our coordinator in Manila when done and verified by our team. I will give you further instructions on these once you decide to open an account with any of these mutual funds. Meanwhile, prepare a photocopy of at least 1 Philippine gov’t-issued ID such as passport, SSS ID, driver’s license, etc. Sign 3 times on the sides of the photocopy.

4) Remit/deposit/transfer the funds directly to the bank accounts of the mutual funds. Download the prospectus here for funding details.

5) Send a copy of the proof of remittance/deposit slips/transfer.

6) Sit back, relax and wait for your next desired schedule to invest.

Do you want to know more about mutual funds and how to invest in it? Email a message to burngutierrezblog@gmail.com with the subject ‘MF-BurnGutierrez’.

mgkano ang initial investment po?

Hi Anne. Most mutual funds ang minimum initial investment is P5,000 only.

Interested! Pls send me details on how @ dyaney_0308@yahoo.com

Hi Burn,

What do you think happened to my investment?

I paid 50k to philm strategic growth fund last 2013, and I never topped up.

Upon checking this year, my 50k investment became 49k only.

Is it because i didn’t top up? did not do peso cost ave?

sayang.

Just asking for your thoughts on this.

thanks

Philam Strategic Growth Fund is a very high risk fund but with a possibility of high pay of course. Maybe the investment porfolio (?) under this fund (not so famous portfolio which has potential to grow) did not made a boom such that selling price at the end of the year is lower than the buying price at the start of the year. Not very sure though, kindly correct me if I am wtong.

paano madownload nag form ng philequity…isa p.o. akong ofw.salamat

Hi @Marivic, pwede mo ma-download ang forms dito: goo.gl/y7nnxq

Sir anong mutual fund company po ba ang magandang kunin? Ofw po ako thanks

Sir, I need more knowledge about mutual fund, pls advise if anong mutual company Ang magandang kunin. Many thanks

Hi Felda, please email me your contact number. My email address is burngutierrezblog@gmail.com para makapagusap tayo.

Hi!Matagal ko na po gusto mag invest sa mutual fund since nalaman ko na my ganito pala kaya lang po pagnag iinquire sa lahat need mg tin number whivh is wala ako kaya hndi ako makaumpisa ng investment ko kahit gustong gusto ko.please help me.

Thank you.

Hello Julie, nasa abroad ka ba ngayon? Pwede kang magpadala ng authorization letter sa kamag-anak mo sa Pilipinas kasama isang ID mo. Sila ang kuhanin mo ng TIN sa BIR na malapit sa inyo. Meanwhile, pwede ka na fill out ng forms, to follow na lang ang TIN mo. Email mo ko today burngutierrezblog@gmail.com

Hi.

Interested po ako sa mutual fund pero di ko po alam ano ang magandang mutual company po. Been researching about mutual funds recently po. I need your expert advise sir.

Thanks

Hi Kai, kindly email me at burngutierrezblog@gmail.com

hi sir burn. ask ko lng if saan ako pwede mgcheck ng yearly performance (gain/loss) ng each mutual fund stated above? thanks po. 😊

Hi Carl, pwede mo i-check dito: http://www.pifa.com.ph/factsfignavps.asp