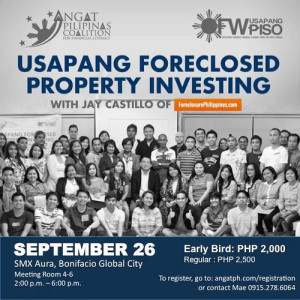

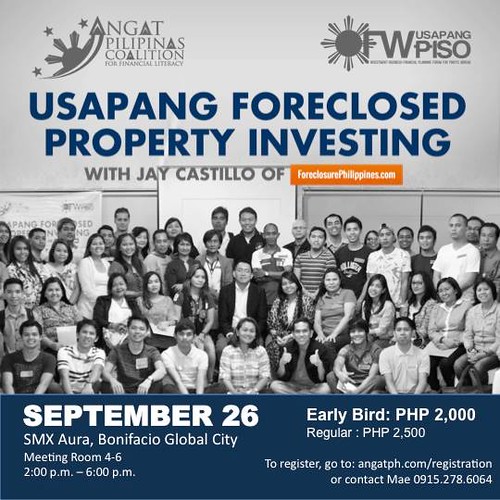

We have conducted two batches already of our Usapang Foreclosed Property Investing featuring our friend and real estate investing mentor Jay Castillo of ForeclosurePhilippines.com but people are craving for more.

That’s why we are offering the 3rd batch of this series to all those who were not able to attend the first two batches.

Before you join and register for the 3rd Usapang Foreclosed Property Investing seminar, here are few of most asked questions to help you out about foreclosed property investing taken from Jay’s website.

1. Are all properties listed by banks foreclosed?

ANSWER:

Bank listings usually only include foreclosed properties as they are not really in the real estate business. S

ometimes however, you will also see some bank acquired assets for sale which they got as payment through a dacion en pago or payment in kind, as a result of foreclosure proceedings.

2. Can I ask the bank for the copy of the title?

ANSWER:

Yes, just need to ask for a copy and they should give you a photocopy which you can use to check/verify at the registry or deeds by getting a certified true copy.

3. I am just curious what happens to the unsold properties in the auction? Does the bank reschedule them for another auction or can buyers make an offer to the bank at the starting bid price?

ANSWER:

For Unionbank, they usually set another auction for the unsold properties about a month later.

For auctions conducted by CBRE, they usually come out with post auction listings where “best offers” are considered, which means interested parties can submit offers below the minimum bid price.

For RCBC, they usually schedule another auction and take off 5% from the minimum bid price(MBP) for unsold properties.

4. Tanong ko lang po kung pwede pang mag habol yung dating may ari yung property pag fully paid na po ng buyer. And pano rin po pag dipa fully paid yung property pwede pa rin po basila mag habol?

ANSWER:

If tapos na yung redemption period, wala nang habol yung dating may ari.

If I’m not mistaken with the legal terms, the redemption period is one year after the execution of the foreclosure. Kahit hindi pa fully paid ang new owner, basta nag lapse na yung one year na redemption period, wala na ring habol ang previous owner.

Usually, banks only sell foreclosed properties whose redemption periods have already lapsed. Although they usually inform interested parties if the redemption period has lapsed or not, it would be better to double check, just to be sure.

5. Please expound the clause “as is, where is” for foreclosed properties?

ANSWER:

“as is, where is” generally means the buyer agrees to purchase the property at its present physical condition including but not limited to any problems or legal issues the property maybe involved in.

Best practice is for the buyer to thoroughly inspect the property and check for any lis pendens, annotations, etc., on the TCT plus trace-back plus any arrears on taxes, dues, etc. that maybe for the account of the buyer.

It would be highly recommended to check the auction guidelines as well on how the term “as is, where is” is defined by the bank conducting the auction.

6. What are the typical requirements to join an auction as a bidder?

ANSWER:

Aside from the show money or manager’s check, the winning bidder must submit all requirements as stated in the conditions of sale.

Learn More From Jay Castillo of ForeclosurePhilippines.Com

BATCH 3 is coming up!

Attend the 2nd 3rd batch of the Usapang Foreclosed Property Investing seminar on September 26, 2015 at the SMX Aura Convention Center, Bonifacio Global City in Taguig City.

Early Bird: PHP 2,000 (until August 31, 2015 ONLY)

Regular (online): PHP 2,500

On the Day: PHP 3,000

* Food will be served

To register for the next Usapang Foreclosed Property Investing seminar, click the banner below or please go here-–>http://angatph.com/registration/

Learn more how to make your money grow through real estate by subscribing to BurnGutierrez.Com for FREE.

Join the OFW UsapangPiso Facebook Group to learn how to plan your finances the right way and how to grow your money in various financial instruments and investment vehicles such as stocks, mutual funds, UITF’s, bonds, money market, real estate, and others.

Rock your way to abundance!

#moneyliferocknroll

P.S. 1. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

P.S. 3. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. Order your copy now from our website http://pepotanddora.com and have it delivered right at your doorstep. Or you can grab your copy yourself at The Pantry at 07 in Makati City and ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 4. If you are based abroad or just outside of Metro Manila and has been itching to learn more on how to jumpstart your business dreams, join me and my friend, serial entrepreneur Ginger Arboleda, as we take you through a series 2-hour webinars (for 11 Saturdays) that will help you focus on the technical skills and specific things that you have always wanted to know about in order to grow your business. We have come up with 10 sessions with 11 expert lecturers (with 1 FREE session if you enroll in the full program) that will make you a stronger and better entrepreneur. Register here to join the Enter Entrepreneurship Webinar Program now!

P.S. 5. Learn How To Make Money From Foreclosed Properties! We are on our 3rd run of the Usapang Foreclosed Property Investing with Jay Castillo of ForeclosurePhilippines.com! Happening on September 26, 2015 at the SMX Aura, Bonifacio Global City. Click here to register and avail the early bird promo!

P.S. 6. Buy insurance products online! Visit the very first online insurance store in the Philippines: the AXA iON! Purchase your alternative savings plan, educational plan for your children, medical emergency plan, and your life insurance by clicking HERE.