Manila Workshops, with partner LifeQuest Training and Consultancy Corporation, announced today that it will be hosting the “Gear Up for the ASEAN Integration” conference on September 5, 2015. The conference will take place at the SMX Convention Center, SM Aura in Bonifacio Global City, Taguig, Metro Manila from 9:00 am until 4:00 pm.

The integration of the ten ASEAN countries into one economic community is anticipated to generate significant opportunities for Filipino professionals and entrepreneurs. Thus, the organizers of the conference expect the event to help many understand and prepare well for the implications of the envisioned single market and production base.

Among the speakers at the conference are former Congressman Ruffy Biazon who will talk about “Customs Integration and Philippine Trade: Where are We?,” LEAN management expert Mr. Homer Villa who will explain “Transforming Philippine Manufacturing Through LEAN,” business builder Mr. Sonny Del Rosario who will discuss “Transforming Small Business for the ASEAN Community” and Mr. Elvin Uy who will talk about “K-to-12: How it prepares us for the ASEAN Community.”

For more details about the conference, please email chinky.magtibay@manilaworkshops.com or visit the registration page for Gear Up The ASEAN Integration at the Manila Workshops website.

Follow our educational events by subscribing to BurnGutierrez.Com for FREE.

Rock your way to abundance!

#moneyliferocknroll

P.S. 1. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. Due to popular demand, my good friend and business partner Jon Orana will be releasing again his online program called the Internet Business Master Class. This exciting online learning program is about creating and selling e-books in the internet. Here’s a FREE 23-page step-by-step guide on how to make money selling e-books including which topics to write.

P.S. 3. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

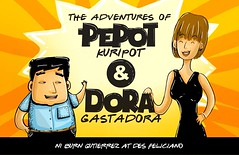

P.S. 4. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. Order your copy now from our website http://pepotanddora.com and have it delivered right at your doorstep. Or you can grab your copy yourself at The Pantry at 07 in Makati City and ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 5. If you are based abroad or just outside of Metro Manila and has been itching to learn more on how to jumpstart your business dreams, join me and my friend, serial entrepreneur Ginger Arboleda, as we take you through a series 2-hour webinars (for 11 Saturdays) that will help you focus on the technical skills and specific things that you have always wanted to know about in order to grow your business. We have come up with 10 sessions with 11 expert lecturers (with 1 FREE session if you enroll in the full program) that will make you a stronger and better entrepreneur. Register here to join the Enter Entrepreneurship Webinar Program now!

P.S. 6. Learn How To Make Money From Foreclosed Properties! We are on our 3rd run of the Usapang Foreclosed Property Investing with Jay Castillo of ForeclosurePhilippines.com! Happening on September 26, 2015 at the SMX Aura, Bonifacio Global City. Click here to register and avail the early bird promo!

P.S. 7. Buy insurance products online! Visit the very first online insurance store in the Philippines: the AXA iON! Purchase your alternative savings plan, educational plan for your children, medical emergency plan, and your life insurance by clicking HERE.