People who have been introduced to stock market investing recently have started to be exposed and be curious about other financial instruments available in the country for ordinary citizens today. Among these investment vehicles, the mutual funds and UITF’s (unit investment trust funds) have garnered the most popularity.

[Do you want to start investing in mutual funds but worried because you’re based abroad? Let me assist you. Click here]

It’s the other way around for me since I invested in mutual funds first before deciding to put my money directly in the stock market years back. It is actually the “cornerstone” in my current mission to help people achieve their financial goals and eventually become financially independent in the near future.

Let’s go back to basics once more and see if mutual funds or UITF’s are the best investment vehicles to ride in to achieve your financial goals.

What Are Mutual Funds and UITF’s?

Mutual funds and unit investment trust funds are both classified as “pooled” investments or funds that are contributed hundreds or even thousands of individual and corporate investors.

Unlike investing directly in bonds or the stock market, putting your money in mutual fund or UITF somehow lightens your responsibility and lessens your time in studying the market since that area has been transferred or delegated to the fund managers of the investment company (mutual funds) or the bank (UITF’s) in hope that they will strive to give higher returns for your investment.

Mutual funds and UITF’s are great investment vehicles to reach your financial goals. Are you looking forward to your child’s college education? How about your retirement years? Probably a brand new house or your first car? Or your dream business perhaps?

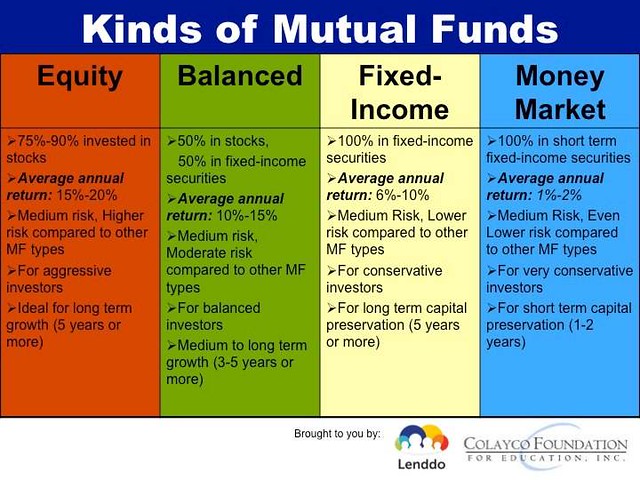

Here’s a very simple and comprehensive illustration from our partners Lenddo and Colayco Foundation for Education showing the types of mutual funds with details on where they are invested, the average annual returns, their respective risk levels, and the timeline or investing horizon. See for yourself which one fits your goals and your investing profile the most.

Which mutual fund or UITF fits your needs and personality?

To give you further understanding, here’a a video (only) shortie lecture from Investools for you to determine which mutual fund (or UITF) is best for your investing profile.

What are the differences between mutual funds and UITF’s?

Here are the differences between mutual funds and UITF’s as clearly illustrated by our friend celebrity blogger Fitz Villafuerte:

Where to invest

- MF: A mutual fund company. They are sold by licensed mutual fund agents. Here’s a list of Philippine mutual fund companies.

- UITF: Commercial banks, particularly their trust, investment or treasury department. They are sold by authorized bank employees. Check out the BPI Investment Funds and BDO UITF Products.

Who regulates these companies

- MF: Securities and Exchange Commission (SEC)

- UITF: Bangko Sentral ng Pilipinas (BSP)

What you are buying in a fund

- MF: Common shares in the investment company

- UITF: Units of participation in the fund

The price of the fund is expressed in terms of

- MF: Net Asset Value Per Share (NAVPS)

- UITF: Net Asset Value Per Unit (NAVPU)

Investment fees and their usual range

- MF: sales charge (1% – 5%), redemption fee (0.5% – 3%), investment advisory, distributor and administration fees (1% – 2.5%)

- UITF: sales charge (0% – 2%), redemption fee (1% – 2%), trust fees (1% – 1.5%)

The illustration below shows how much you would have earned on December 23, 2014 from your stock fund or equity fund if you invested your money in January 1, 2014.

As in any type of investment, it’s always recommended to study about mutual funds and UITF’s further before deciding to put your money in them. Don’t invest in anything just because everyone else has them in their portfolio.

If you want to start investing in mutual funds right away, send me an email today and I will gladly assist you for FREE! Email burngutierrezblog@gmail.com now! 🙂

Rock your way to abundance!

#moneyliferocknroll

—

If you want me to coach you in improving your finances, type your name and email below and click the Subscribe button:

Investing in MF or UITF is a great way to leverage on other people’s effort and money.

Would love to read more enlightening articles from you, bro!

In UITF which you are buying units of participation only – not shares of a company, that means you don’t have the perks that MF or stock holders have, like having a dividend yield. Correct me if I’m wrong but I think UITF gains from capital appreciation alone… or maybe not??

Yes, UITF’s don’t pay out dividends. But take note that not all MF’s give dividends to investors as well.

Thanks dito bro. Let me share this one ha 🙂

Sure bro! Let’s meet later this year. Salamat!

It can’t be a better place to read and improve knowledge about stock broking or investment planning then your blog. It was a pleasant time which i spent on your blog. thanks for sharing such a valuable information with us. Hope to visit your blog again and read even more interesting articles from you.

With Reagrds

The Finapolis Magazine

Which of the two has better tax advantage? Thank you for all value you share in this blog!

In terms of taxation, the treatment is just the same for both MF’s and UITF’s. There are just some misinterpretations on taxation of UITF’s. MF’s load fees/charges are usually more as compared to UITFs’. Thanks for reading.

What are the processes to start investing in mutual funds or UITF`s

Hi Japeth, for mutual funds, visit http://pifa.com.ph/memlist.asp and check out the companies mentioned there. Visit their respective websites and look for the instructions on how to open one.

For UITF’s, visit http://www.uitf.com.ph/fund-matrix.php#gsc.tab=0 and choose the fund that you want to know about. You can open an account via the banks that you will find there.

By reading your blogs, I am being introduced to financial education. I want to improve my financial knowledge so that I can be able to contribute in the financial advocacy. I just want to ask where can I possibly attend a seminar on financial management as my starting point in my journey of financial education.

Hi Joel. Are you in the Philippines or abroad? Please join these Facebook groups so you can be updated on the latest seminars and learning events:

https://www.facebook.com/groups/OFWusapangpiso/

https://www.facebook.com/groups/angatpilipinas4studentfinancialliteracy/

or visit our group’s website http://angatph.com/

Hi! I am Charm Constante. A financial advisor and SEC-licensed investment solicitor of Sunlife of Canada (Phils), Inc. You can talk to me regarding financial help about mutual funds. Feel free to ask for appointment. Here’s my email charmischelle.m.constante@sunlife.com.ph or message via SMS at 09178323968. Thanks!

Hello, I would like to share this blog of yours (Which Mutual Funds and UITF Should You Invest In) May I?

yeah, this is true.

I have invested in this since 2011, i learned all of them thru my friend. i am glad i am part of this….