First, let us determine what bonds really are.

Bonds are a kind of “utang” (loan) by an investor from another individual or entity. It is classified as “fixed” because there is a specified interest rate and a specified maturity date or settlement period.

For example, I will borrow from you a principal amount of Php100 and i promise to pay you after 1 year with a fixed interest of 5%. Which means I will be returning to you an amount of Php105 at the promised (maturity) date after 1 year.

The same applies when the government, a large corporation, a financial institution, or any business entity announce that they want to “borrow” money from the public, from YOU, to fund their respective investments or projects. You are actually “purchasing” a bond when you lend your money to these entities.

This “borrowing” transaction is bound by a contract between you as the lender and any of the above-mentioned entities as borrowers. These borrowers agree to pay you a fixed interest quarterly or semi-annually as a compensation and also agree to repay you the total principal plus the fixed interest rate at the maturity date.

What Are The Types of Bonds?

The bonds issued by the government through the Bureau of Treasury are called Treasury Bonds and are also known as Government Securities. This type of bonds are very safe and almost risk-free for individuals and OFW’s because it’s the government that is guaranteeing that they will pay you back in time. Remember how much we pay for taxes? They got cash, dude. 😉

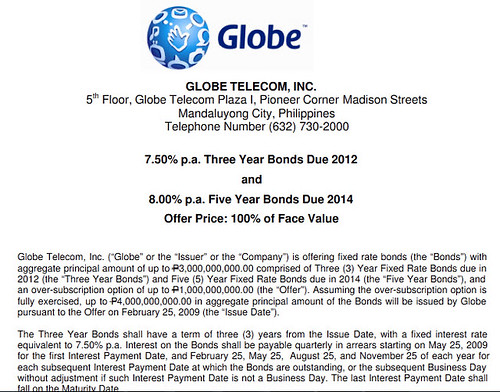

However, large private companies also issue Corporate Bonds whenever they expand their business or if they have major projects that need further funding. Corporate Bonds are usually offered at a higher rate than any other types of bonds. It is recommended that we invest in Corporate Bonds issued by the largest companies only to ensure maximum safety for your money.

But Bonds Are Expensive, Aren’t They?

That’s partly true. In fact, most Treasury Bonds are sold at a minimum amount of Php100,000. Although there are Corporate Bonds that are sold at a minimum amount of Php50,000 or sometimes at Php25,000 only.

But another truth of the matter is that with just Php5,000 you can already purchase bonds. These bonds are called Retail Bonds. It’s called “retail” because these entities sell their bonds at very minimal increments. Securities issued by the government in retail prices are called Retail Treasury Bonds or simply RTB’s.

Cool. But Where and How Can I Buy These RTB’s or other Retail Bonds?

Retail bonds can be purchased through banks selected by the issuing government agency or private companies. Basically, one is required that you have an existing account with the issuing bank of your choice.

However, there are flexible cases when anyone can purchase bonds from any bank or institution even if you do not have an account with them.

Update: Petron Corp., the country’s second largest corporation in 2017 by gross revenue, is offering the last two tranches of its fixed-rate bonds worth Php20 billion. Petron’s Series C and D have annual interest rates of 7.8% percent and 8%, respectively. Series C will mature on April 19, 2024, while Series D will mature on October 19, 2025.

You may also get it from other PDEX-accredited brokers found through PDEX website.

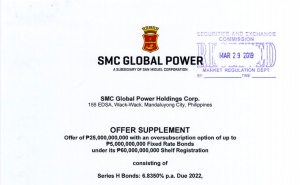

UPDATE: SMC Global Power Holdings Corp., the power subsidiary of San Miguel Corporation, is offering a 3-year Series H bonds due in 2022, the 5-year Series I bonds due in 2024, and the 7-year Series J bonds due in 2026. The Series H will yield an annual interest rate of 6.8350 % while the Series I will bear 7.1783 % interest. The Series J, which will take the longest to mature, will yield the highest annual returns among the three at 7.6%. Read through the offer supplement here.

Advantages of Investing in Bonds

Generally speaking, investing in bonds is far more safer than investing in stocks. However, this does not mean that you have to invest all your money in bonds alone. You need to diversify your funds and invest a larger portion in stocks and the rest with fixed income securities such as bonds. Remember that with high risks, you also reap high returns.

But what are the advantages of investing bonds?

1) Capital Preservation. With government and most high-quality corporate bonds, your money is safe and “risk-free.”. It is also tradable.

2) Sure Future Returns. You know that you will receive your interest as agreed get back your money at maturity date. Even during recessions.

3) Way Better Than Savings and Time Deposit Accounts. If you are saving for your future, then Bonds will be one of your solutions, not savings and time deposit accounts. Regular bank accounts offer very low interest rates and are subject to taxes and other charges (and even penalties for failing to maintain a required balance or transaction.)

4) Can Be Used As Collateral. For serious investors and entrepreneurs, there comes a time when they need to apply for a loan in the banks or other financial institutions. If you have an investment in bonds, these can be used as a guaranty or collateral for you to be granted loans without further question.

Invest in Bonds NOW, the Sari-Sari Way (Retail Bonds)

Now you know that investing in bonds is stable and safe, it’s best to consider putting a portion of your savings now on retail treasury bonds. This will be one of your cheapest and safest saving vehicles to help you secure your future.

To learn more about other investment opportunities in the Philippines, subscribe to RockToRiches|burngutierrez.com

Rock your way to abundance!

#moneyliferocknroll

—

If you want me to coach you in improving your finances, type your name and email below and click the Subscribe button:

It is also best that dependents of OFW’s get to learn about bonds (and bond funds as well) so that they themselves can start investing on it.