For many Filipinos, having the opportunity to work abroad is a big blessing. However, just as with any form of financial blessing, failure to take care of these jobs abroad may lead to losing them in the process.

Furthermore, forgetting the reasons for desiring to work overseas can slow down the quest to achieving financial freedom.

If you are a Filipino working overseas, the stories of these former OFWs may inspire you to work harder and be prepared for your homecoming soon.

SHINE SAN JOAQUIN

When I had the opportunity to work abroad and left Philippines I was only 23.

At first I had this first 10-year overseas work plan. I set my mind that I will only stay there until I reached the age of 33 because I wanted to have a family of my own by the age of 35.

Initially, my basic salary goes to my mom, my insurance, and my regular savings in the bank. Then after 4 years, I thought I had enough savings and ready to come home. But investment opportunities came one after another and these required me to have more cash to fund them so I had to work and stay abroad a little longer.

Another 4 years went and the decision of coming home was really unplanned. I was having a lot of pressure at work and the environment of the country I was working in wasn’t really helpful in coping up with the obstacles.

The company offered me to have a long break. I’m glad I started saving earlier and regularly, even though sometimes what I really had left for myself then was just enough to sustain my daily expenses. And the investment I started also gave me income.

And while I was still abroad, when I had all the pressures going on at work, I diverted my attention to working on things that made me happy. I enrolled in a class about online business which is giving me passive income currently.

During my last few months of working abroad, I thought of running a travel agency. This is now one of my business ventures.

So my own self prophecy of 10 years stay abroad did not actually come into fulfillment. But I am thankful I took the steps that helped me take new paths to success now that I am home.

Coming home unplanned without good preparation can be really tough. But I always have this reminder “failing to prepare is preparing to fail” as a guide.

Always have a goal. There is no such thing as too early or too late. The only fact I know is you need to have the initiative, determination, and willingness to achieve anything you want.

“Ask and it will be given to you; seek and you will find; knock and the door will be opened to you. For everyone who asks receives; the one who seeks finds; and to the one who knocks, the door will be opened.” – Matthew 7:7-8

———-

JANETTE ESTEBAN

Umalis ako ng Pinas na baon sa utang kaya nag decide àko mag-Hongkong, at naalala ko nga na ni singko wala akong pera.

Sa unang employer ko di rin ako sinuwerte at naranasan ko po doon yung literal na salitang gutom. Kaya lang kailangan ko mag-trabaho. Nang makilala ko ang pangalawang employer ko sabi ko di pwede lagi na lang ganito na kawawa ang pamilya ko. Wala ako naiisip kundi makabayad ng utang at nakasanla ang property namin.

Ok ang pangalawang employer ko na Australian pero Pinay ang asawa niya. Siguro doon ako mas namulat na mahirap maging katulong lalo na kung Pilipina ang amo.

Pero dahil siguro likas na mahilig ako magnegosyo, kahit ano tinitinda ko sa mga kapwa ko Pilipina. Inipon ko lahat ng kinita ko sa mga tinitinda ko na yun.

After 1 year ng contract ko may kaibigan ako dito sa atin na tinanong ako kung gusto ko magpadala ng mga items mula Hongkong at ititinda nya sa mga call centers dito sa Pilipinas. Doon kinausap ko family ko na tulungan nila ako na mag-deliver at maningil.

After 4 months nang buy and sell business ko, maganda ang kinalabasan. Pero dahil kinukulang na ako sa capital noon, nag-loan ako sa bank. Lahat ng sahod ko ibinabayad ko sa loan ko. Hindi ko na naman kailangan magpadala noon dahil kumikita na business ko.

Two months before matapos ang contract ko nag-isip na ko kung uuwi na ba ako o pipirma ako ulit. Natatakot ako umuwi kasi baka sa umpisa lang ang lakas ng negosyo ko. Nag-alala ako paano kung biglà magka-problema? Ano ang gagawin ko? Di pa tapos lahat ng obligasyon ko gaya ng pagbabayad ng utang at pag-aaral ng anak ko.

Iniisip ko lagi kung ilang buwan itatagal ng iuuwi kong ipon? Check ko ang kinikita ñg negosyo at tinitignan ko lagi kung sapat na ba pamalit ito ng sahod ko sa Hongkong? Ano pa pwede ko gawin pag uwi ko aside sa existing business ko para maging fallback ko.

Hindi madali mag-decide lalo na nagnenegosyo din ako ako sa Hongkong na maganda din naman kinikita ko. Pero bukod sa PERA mas nag-focus ako sa desisyon ko na umuwi kaysa ipagpalit ang pagiging nanay ko at asawa sa kikitain ko sa abroad.

Almost one year na ako dito sa atin, mas lumaki ang network ko kasi nandito na ako. Ako na mismo ang nagma-manage ng negosyo ko. Kung may problema sa negosyo mas mabilis masolusyunan, mas malaya ako nakakakilos. Dahil din sa pag-uwi ko naging mas close kami ng family ko kasi involved din sila sa inumpisahan kong negosyo.

———-

NOLAN RAY LAZARO

I worked in Saudi Arabia for more than a year as an IT guy. I went back home thinking that I have lots of savings already. I then worked for 3 months in Pinas and as I see my savings deplete I was forced to go to Singapore and looked for a job. I worked for more than 4 years in Singapore, and this became the turning point. I studied and learned personal finance and investments.

The journey is not easy at all. I knew no one when I started my journey. I read books like Rich Dad Poor Dad by Kiyosaki and that sparked my curiosity to learn about achieving financial freedom.

From then on, I bought and read a lot of books; I attended a lot of seminars, webinars, and attended countless trainings. I prepared my mind (and my pocket) before going back home for good. How? I built my base:

+ Emergency funds

+ Insurance

+ Savings

+ Strategized on which investment vehicles to ride on. Financial vehicles like the Stock Market, UITF, MF, Real Estate etc.

I also engaged in online and traditional business. Knowledge in personal finance opened me to a lot of opportunities. I realized that it is really not how much a person earns but it is how much a person saves and invests that matters. It is also very important to have the right mindset. Financial literacy plus having the right mindset is the reason why I finally got able to go back to Pinas for good.

Now, I have already proven that life is really bigger and better back home. In Singapore I learned that only less that 1% of the Filipino population invests. Knowing the importance of financial literacy, I decided that I wanted to be a financial literacy advocate. I want to share what I know and help OFWs.

Being a former OFW, I know their sacrifices, hardships and pains to be far away from their families in order to reach their dreams and give a better life for their loved ones. That is one of the reasons why I decided to return to Pinas for good. Nagwork din kasi ako as an OFW for many years sa Saudi at sa Singapore, kaya I decided to help OFWs.

Whenever I do talks to OFWs, I always ask “Do you want to waste your youth or your life working abroad, away from your family?” We can never bring back the lost time with our loved ones. My advise to OFWs: Manage your finances well and invest in yourself. High income is never enough, most of the time kapag tumataas ang salary, tumataas din ang gastusin. Lasly, have the right mindset and learn financial literacy.

———-

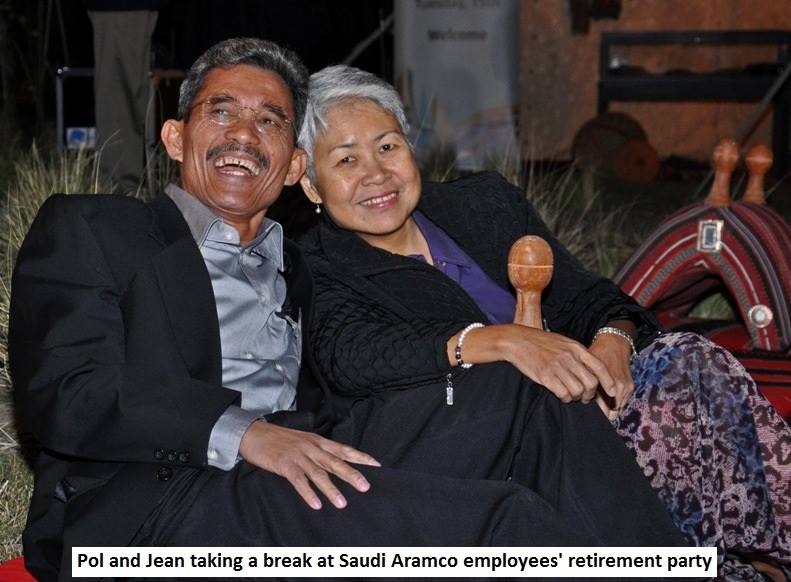

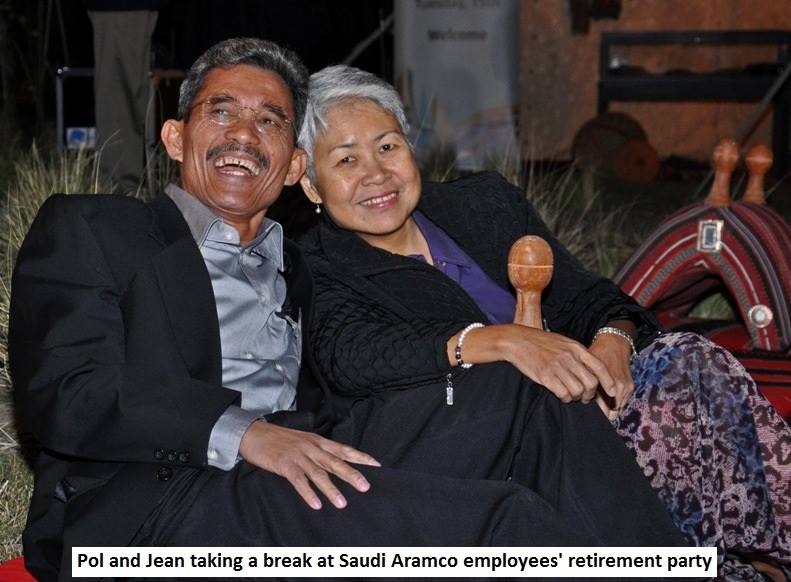

POL ESPANOLA

In the 1970s our family had fallen on hard times; so hard we barely had enough money to buy food. So in 1981, I left to work in Saudi Arabia with one important mission: to gain freedom from want. My job was not secure as it could be terminated in a month notice. To build a safety net in case I was sent home prematurely, I saved much of my salary even as I sent money to support my parents and siblings back home every month. I avoided spending money.

Someone called me Mr. Look See because every night we went on shopping trip, he thought I was always window-shopping while others were buying televisions, stereos, cameras, watches, jewelries, gold, etc. which were quite cheap in the early 80s. No one knew that while they were shopping, I was doing part-time accounting job in a nearby office of one construction company. My extra income enabled me to save almost 100% of my regular salary.

I refrained from buying stuff or pasalubong, or allowing our family to raise our standard of living. It was enough that they didn’t go hungry and all my seven sisters continued their schooling through college. All I wanted was to save as much money as I could, realizing that in my mid-30s, I would no longer be able to secure a suitable professional job when I return home. I resisted the idea of joining friends migrating to Northern America.

I always thought of coming home to our family in the Philippines. Despite its poor economic condition at that time, Philippines always looked beautiful and promising. We only lacked money.

One day I realized I had saved enough money for our family to have freedom from want. Then I figured that if I saved more money, it would be possible for me to live without having to work in the future.

I got so obsessed in saving money that finally when I was retired from work in 2011, not only did my family gained freedom from want, more significantly I achieved financial freedom.

———-

BURN GUTIERREZ

Some of you may not believe that I was an OFW in the Middle East. But I really was.

For the past 5 years, I worked as an auditor and a consultant in a group of companies based mainly in Saudi Arabia. I was one of the few lucky OFW’s who were able to bring their families with them abroad.

During those 5 years, my wife and I supported each other in making sure that we are prepared to go back home anytime. It was never easy and a lot of life challenges and financial struggles came across our paths. We had to sacrifice many of our wants and focused on building our financial foundation back home. We saved money. We looked for other opportunities to earn more. We invested for our future. And most importantly, we made sure we were giving back to God and paying forward to our personal ministries and charities.

Some of our friends and fellow community members criticized us for being “too attached to money” and neglected our responsibility to our spiritual community. For them we were like serving two masters at the same time. But for me and my wife, we only serve one Master and money is just a tool to serve Him and His people.

It was a frustrating episode for me and my wife during those days as the people we were expecting to support us were not there for us. But we held on to our faith in God and focused on our goal of preparing for our possible homecoming soon.

And just as we were preparing for that possibility, my company decided to terminate many of its expat employees in late 2015. I was one of those “unfortunate” ones to be either sent home or offered a contract with a much lower salary package.

When my wife and I heard this news, we both got anxious and happy at the same time. Anxious because going back home for good was like learning to ride the bicycle all over again. Happy because we knew that better opportunities were on our way and we started welcoming those opportunities even while we were still earning abroad.

Now that we’re in the Philippines for good, nothing could be happier seeing my wife and daughter enjoying their time with our parents, siblings, and friends. We can now do things we couldn’t do back then.

Nothing can make one more feel secure and happier than enjoying life with your family back home.

**I now co-manage G&C Financials (business consultancy firm), Angat Pilipinas Coalition (financial literacy organization), EnglishLearningCamp (online language school startup), coaching for TrulyRichClub members, and marketing for bestselling Middle Eastern restaurant Mumtaz FoodAlley.

Prepare Yourself To Come Home For Good

Fellow Filipinos abroad, we encourage you to prepare for your happy homecoming. It will be tough and challenging but it will be worth the sacrifice.

We hope you are able to get some inspiration from these OFWs and learn a thing or two from them. We leave you with this:

“For I know the plans I have for you,” declares the Lord, “plans to prosper you and not to harm you, plans to give you hope and a future.” – Jeremiah 29:11

Be guided on how to prepare yourself to coming back home for good by subscribing to Rock To Riches for FREE.

Rock your way to abundance!

#moneyliferocknroll

—

If you want me to coach you in improving your finances, type your name and email below and click the Subscribe button: