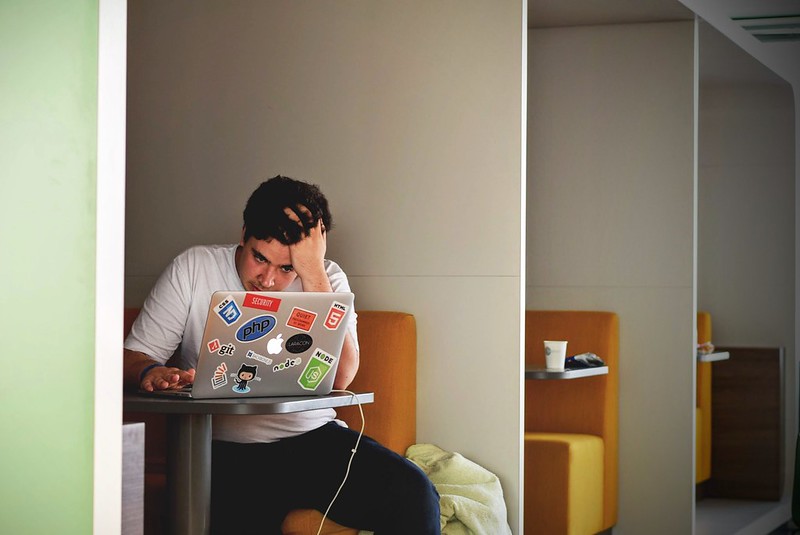

Losing a job that is out of your control is probably one of the most heartbreaking experiences. It can bring you sleepless nights because of bills to pay and other financial responsibilities.

Once you’ve received the pink slip, your mind is already racing with questions: How did that happen? What could you have done something better to not lose your job? But perhaps the most anxious question to ask yourself is “What will I do next?”

Here are seven things to do while you are mourning the loss of your precious job.

1. Don’t panic

It’s natural to be angry and drowned with stress after reading that “goodbye” memo from your boss or HR Department. You have to acknowledge those feelings, but don’t let them discourage you. You are not alone in this dilemma. In fact, about 5.3% percent of the population is unemployed at least according to Philippine Statistics Authority 2018 data at any given time. This should motivate you to look for a job that’s a better fit for you.

Never forget to pray and ask.

>> Click here to join The Freelance Movement Tribe Today! >>(This is a full year program where you’ll basically get your hand held from literally not having any experience to someone who has a highly sustainable freelance business.)

2. Reduce your expenses

When you are employed, there’s money coming in and coming out. But when you are unemployed, you’ll surely want less money going out.

Review your spending habits and discuss with your spouse or family members that you need them to help you cut the expenses. Perhaps it’s time to ditch that cable TV or Netflix subscription for now. Or you can probably start cooking food at home instead of dining out. You can slowly adjust your lifestyle so you can at least control the use of your ATM card during this time.

3. Find Sources of Cash

It is during this kind of times that you need an emergency fund. If you have enough savings, you should be able to make it last for at least 3 months until you find a new gig or job.

If you have a mutual fund or stock investment, you could consider redeeming a portion of it, say 10% to 20% of your total investment. You can use the money as capital to start a small business or pay some more important expenses.

As much as possible, do not touch your retirement accounts or portions of your investments that are allocated for your retirement.

Another source of cash (and probably your next career) is by tapping income-generating potentials from the internet. There are endless opportunities to earn money from freelancing and online businesses. Our ebook “How To Use The Internet To Achieve Financial Freedom” can help you start that online business soon. You can download the ebook for FREE here >> Internet Raket Science Program

You may also sell some of your stuff and post them on Carousell or OLX. These sites have substantial followings and customers that could be interested in purchasing your used or pre-loved items.

4. Get a health insurance

Many people rely on benefits that go with their employment. That includes the free coffee in the pantry, that one roll of tissue paper, that one ream of bond paper, and yes, that health insurance card. When you lose your job, you lose them all.

Signing up for your independent health insurance will benefit you in the long run so make this a priority. Set aside an amount from your emergency fund or redeemed cash to find and buy a health coverage for yourself. It’s always best to protect yourself especially if you are the breadwinner.

5. Stay Visible with Friends and Contacts

The best thing about this generation is that you can always keep in touch with people no matter where you are and no matter what situation you are currently in. Even though you have lost your job, using the social media can keep your friends updated on what’s going on in your life.

It may be a private thing for you, but spending time communicating with your contacts in LinkedIn or attending free events with your friend to network with potential employers and business partners can be very helpful to you.

6. Stay Healthy and Eat Nutritious Food

You may not feel like eating the way you’ve been doing but keeping yourself in good shape can invite positive vibes in your life. Take short walks or runs in the morning while reflecting on what you could have done better.

Eat nutritious but inexpensive food like vegetables (malunggay and kangkong are on top of the list) and fruits. Perhaps you could also start planting your own vegetables as part of your daily routine. This will also save you money as you will not need to buy them anymore from the supermarket or palengke.

7. Begin the Job Search

Update your resume and your LinkedIn profile. You may ask your friends what they think you are great at so you can explore other careers that you have not tried.

The step number 5 above should set you now in a “talk mode” and let the people in your network know that you’re up for hire. Personally, I got more leads and job interviews from acquaintances and LinkedIn contacts that in my close circles. Although I have to thank my fraternity brethren for helping me get my first professional job right out from college.

Finally, be patient in waiting for call ups and interviews as hiring processes always take time. Patience is always a virtue even during a job search.

Never give up!

Rock your way to abundance!

#moneyliferocknroll

— —

If you want me to coach you in improving your finances, type your name and email below and click the Subscribe button:

========

Do you automatically zone out at the mere mention of investments, insurances, and options for retirement?

Financial literacy is such an important topic, so we made it a more fun and digestible read in my latest book, #MoneyTroubleShooters!

Read more about the book here ➡️ http://moneytroubleshooters.com/about/