In my previous post about depending solely on SSS/GSIS/HDMF to cover for one’s retirement expenses and needs, we mentioned that the pension that you will be receiving from these institutions will never be enough.

These employer-sponsored retirement plans can be a good start for a young employee while learning about other investment options that can generate higher returns.

Two of the most commonly-recommended financial instruments to invest in for long-term are stocks or equity funds through mutual funds or UITF’s. But are these really your reliable friends to entrust your money from Investing Day 1 up until your retirement age?

Are Stocks and Equity Funds Reliable Investment Vehicles?

Many new investors have been amazed by the awesome performance of the Philippine stock market in the past 2 to 3 years which touched the 7,000+ level earlier this year. Most have gained more than they’ve lost.

Some even got more excited and decided to put in more money, albeit one time, in stocks or funds that perform best in terms of returns. Others took loans from the bank and invested the borrowed money directly in stocks.

But then the shocking moment of truth came.

The stock market isn’t always dancing in the park. The PSE index went down from 7,000+ to less than the 6,000 level in the middle of the 2013.

Many of those who borrowed and invested their savings without even looking into their other personal needs and responsibilities have started to doubt. I’ve even heard that some have started cursing and blaming their respective gurus and “mentors”.

Worst, they have not even started to build up their emergency funds and have no other recourse but to borrow again to pay for their urgent needs and expenses.

In these situations, they ask, can stocks and equity funds still be considered as an investor’s long-term bestfriend?

Plan and Scatter Your Money in Other Buckets

Equities (stocks or mutual funds) can really give an investor higher growth potential than other types of financial instruments if used as vehicles for a retirement plan. But it is never a guarantee to give you back the money that you need in the middle of your investing journey.

That is why it is important to know the things you need to do first before putting your money in high risk instruments such as stocks and equity funds.

Proper needs budgeting, preparing for emergencies, eliminating bad debts, insuring yourself, and learning more about money’s behavior and improving your behavior towards money as well are things you need to establish before investing.

Remember that even big, “reliable” stocks that we fondly call blue chips can surprisingly change from green to red in no time at all. You just can’t blame anyone else but yourself if you don’t do the right things the first time.

Putting some of your savings in diversified funds either through mutual funds or UITF’s that are heavily invested in fixed income instruments such as bonds and money market can minimize the risk of losing more of your money.

Do not “over-rely” your investment in one asset class only especially if you are nearing your retirement.

Stocks and equity funds can always be your retirement plan bestfriends but it’s your attitude towards money that can be your financial independence enemy in the making.

Follow my articles by subscribing to BurnGutierrez.Com for FREE.

Join the OFW UsapangPiso Facebook Group to learn how to plan your finances the right way and how to grow your money in various financial instruments and investment vehicles such as stocks, mutual funds, UITF’s, bonds, money market, real estate, and others.

Rock your way to abundance!

#moneyliferocknroll

P.S. 1. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

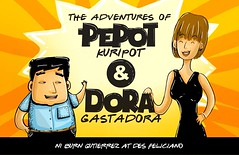

P.S. 3. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. Order your copy now from our website http://pepotanddora.com and have it delivered right at your doorstep. Or you can grab your copy yourself at The Pantry at 07 in Makati City and ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 4. If you are based abroad or just outside of Metro Manila and has been itching to learn more on how to jumpstart your business dreams, join me and my friend, serial entrepreneur Ginger Arboleda, as we take you through a series 2-hour webinars (for 11 Saturdays) that will help you focus on the technical skills and specific things that you have always wanted to know about in order to grow your business. We have come up with 10 sessions with 11 expert lecturers (with 1 FREE session if you enroll in the full program) that will make you a stronger and better entrepreneur. Register here to join the Enter Entrepreneurship Webinar Program now!

—

Photo credit: OTA Photos

Good read! Actually, following your risk appetite, stocks can be your real good long term buddies. For starters at hindi pa masyadong gamay ang stock market or kahit sa mga marunong na, diversifying your portfolio is really a good advice. Base from my experience kung average ang risk appetite mo, put your money sa blue chips. Pero watch out pa rin sa mga news dahil very unpredictable ang stock market.

How to put money in stock market?

Hi Jennet! You need to open an account with a stockbroker for you to buy shares of companies in the Philippines. Check out this links from my stockbroker:

How to Invest in Stocks: https://www.colfinancial.com/ape/Final2/home/new_to_investing.asp

Opening an account: https://www.colfinancial.com/ape/Final2/home/open_an_account.asp