I have noticed so many nasty yet arrogant reactions from netizens against people who either have been recruited by pyramid schemers or are the proponents of the scams themselves.

Most of them are seasoned investors/traders or have been “financially-educated” by financial literacy seminars and Facebook forums. It is as if they are no longer vulnerable to these schemes and fraudsters.

I may sound now like I’m attacking the wrong persons. Do not misjudge me.

I am writing this to let you know that I have close friends who are supporters of the financial literacy awareness campaigns but have become victims of scammers while being an advocate. One was a victim of a managed forex broker and another by a “promising MLM” company.

It’s just so ironic that a few of them were once heavy critics of the scams that they eventually entered in. And lost money in the process.

According to a FINRA (Financial Industry Regulatory Authority) Foundation survey back in 2007, almost anyone who invests is a potential fraud target, though you can reduce your vulnerability if you know what to guard against. That survey examined how known investment scam victims differed from non-victims. Among its key findings, the survey identified several investment fraud risk factors, including:

Owning high-risk investments, including penny stocks, promissory notes, futures, options or private investments in foreign currency;

Relying on friends, family, co-workers, and even Facebook group “personalities” for financial advice (in that survey done in the US, about 70 percent of the victims made an investment based primarily on advice from relative or friend);

Being open to new investment information (the survey said that three times as many victims went to a free investment seminar);

Failing to check the background of an investment or investment professional (for example, one in eight victims failed to check whether an investment professional had a criminal background, and one in seven did not check their licensing or registration); and

Inability to spot persuasion tactics used by fraudsters.

How To Protect Yourself from Scammers

Aside from watching out red flags of fraud and learning how to identify and avoid the persuasion tactics scammers use, it is very important and critical that you ask questions about investments and the people who sell them. Here are two short recommendations:

1) Investigate the Background of the Investment Broker or Distributor — Never be shy by asking the investment broker or seller whether what they are promoting is licensed to sell that investment and ask for a proof that they are registered with the SEC, the BIR or even at DTI. If an individual broker, make sure that he is registered and certified by SEC or the Insurance Commission (if he is an insurance agent, aka financial advisor).

2) Investigate the Investments — Ask whether the investment vehicle is registered and, if so, with which regulator. Most investors will want to buy securities products that are registered with the SEC or the BSP or other government regulators. You must remember that companies must be registered first with the SEC before they can sell securities to the public.

I hope you will do your assignment first by re-reading this article before jumping to any kind of “investment” soon.

Be scam-free, you educated financial literacy advocate!

Know how to protect yourself from scammers and fraudsters by subscribing to BurnGutierrez.Com for FREE.

Rock your way to abundance!

#moneyliferocknroll

P.S. 1. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

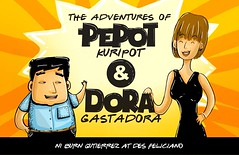

P.S. 3. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. Order your copy now from our website http://pepotanddora.com and have it delivered right at your doorstep. Or you can grab your copy yourself at The Pantry at 07 in Makati City and ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 4. If you are based abroad or just outside of Metro Manila and has been itching to learn more on how to jumpstart your business dreams, join me and my friend, serial entrepreneur Ginger Arboleda, as we take you through a series 2-hour webinars (for 11 Saturdays) that will help you focus on the technical skills and specific things that you have always wanted to know about in order to grow your business. We have come up with 10 sessions with 11 expert lecturers (with 1 FREE session if you enroll in the full program) that will make you a stronger and better entrepreneur. Register here to join the Enter Entrepreneurship Webinar Program now!

P.S. 5. Learn How To Make Money From Foreclosed Properties! We are on our 3rd run of the Usapang Foreclosed Property Investing with Jay Castillo of ForeclosurePhilippines.com! Happening on September 26, 2015 at the SMX Aura, Bonifacio Global City. Click here to register and avail the early bird promo!

P.S. 6. Buy insurance products online! Visit the very first online insurance store in the Philippines: the AXA iON! Purchase your alternative savings plan, educational plan for your children, medical emergency plan, and your life insurance by clicking HERE.

P.S. 2. The 1st Angat Pilipinas Financial Literacy Awards has opened the nominations phase for the Blogger of the Year, the Author of the Year, Advocacy Group of the Year, and the Institution of the Year Awards. Got someone in mind? Submit your nominations here!

Sir Burn, actually member din ako ng TRC/IMG mejo hirap pa mag adjust kung paano mag share sa mga kaibigan ko tungkol dito… For start lang po pwede kopyahin ko muna yung mga gawa mo then ilagay ko na lang yung credits sa baba for reference. Para magkaroon lang ako ng start for making my own blog… di pa kasi ganun kalaki yung experience ko sa investment and starting pa lang ako. thank you and god bless…