What if you died today? Are your loved ones prepared to settle the financial concerns you left behind?

Will your children still be able to go to school? Will they be eating the same food you are enjoying with them today?

Sad and creepy as it may sound but if you answered NO to those questions then it’s time for you to consider getting a life insurance NOW.

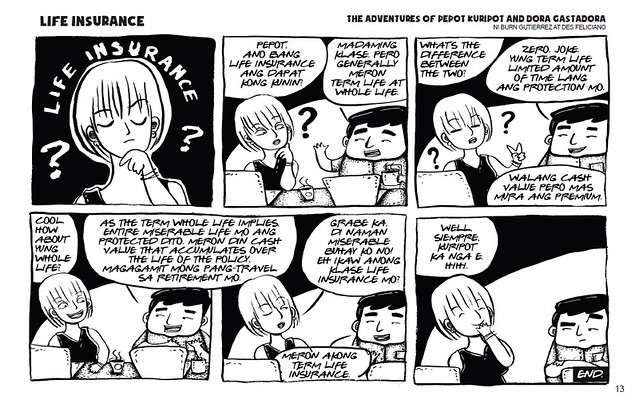

As we mentioned before, there are mainly two kinds of insurance policies: Term Life and Whole Life.

Our friends Pepot and Dora explains below the differences between these two policies. This comic strip is taken from my comic book The Adventures of Pepot Kuripot and Dora Gastadora (shameless plugging).

Gets na?

But apart from knowing the differences between Term Life and Whole Life insurance policies, it is also important that you learn the more unfamiliar insurance terms before shopping for the best one.

Here are the six basic terms about insurance that you should know if you are searching for your first policy.

1) Death Benefit

This is the amount of money that the insurance company will pay to your dependents when you die.

Remember that the more financial needs and expenses you have, the higher amount of death benefit you should have.

Insist with the financial advisor or the insurance agent to conduct a comprehensive financial needs evaluation (which I suppose they should really do) before going through the different insurance products that he or she will offer.

2) Premium

This is the amount that you will pay on a periodic basis for you to be able to be covered with insurance.

The payments can be arranged on a monthly, quarterly or annual basis. The amount of the premium is based on the risk assessment results of the underwriting process.

3) Underwriting

The underwriting process will help you determine which type of life insurance policy or product suits your financial needs and goals.

The decision will be based on the potential risks associated with your age, medical history, among other factors.

That’s why you should expect to be asked whether you are a smoker/drinker or not.

4) Beneficiary

This is the person or an entity who will receive the death benefit or the proceeds of the insurance policy in case of your death.

You can actually name your spouse, your children, siblings, and other relatives as recipients of the benefits.

If you don’t have any relatives left, you can even name anyone or any institution as your beneficiary.

5) Cash Value

There are certain types of insurance policies that allows the insured to withdraw or borrow money from.

These days, some life insurance products are considered investments as well because of this feature.

However, remember that access to cash values through borrowing or partial surrenders will reduce your policy’s cash value and death benefit.

6) Riders

These are the different types of benefits that you can add to your main insurance policy. If you avail any of these riders, your premium will increase.

One example of a rider is “critical illness benefit”. This type of rider will pay you a lump sum amount if in case you are diagnosed with any of the critical illnesses specified in the insurance policy.

Examples of these illnesses include cancer, stroke, kidney diseases, heart attach, and others. This health insurance rider will provide you money to use to treat your illness.

Ready to buy your first life insurance policy?

Know more about protecting yourself and your assets by subscribing to RockToRiches|BurnGutierrez.Com.

Rock your way to abundance!

#moneyliferocknroll

So term life insurance premium is cheaper than whole life but I can no longer recover the premium paid in term life right?

Based on this, Whole Life with Cash Value(Like a Mutual Fund?) and necessary riders would be nice.

Haven’t started comparing companies yet though (Analysis paralysis, I guess).

I am 59 and looking for a good insurance.