The (feeling) young and new investors naturally become curious with the different terms in the financial markets. These include fundamental analysis and technical analysis.

Generally, technical analysis is used by traders, while fundamental analysis is used by investors. I hope by now you already know whether you are an investor or a trader.

Before we determine which technique fits your risk profile as a new investor/trader in the stock market, let us define first what fundamental and technical analyses mean.

What is Fundamental Analysis?

Fundamental analysis starts with the financial statements. This school of thought looks at the financial data of a stock/company to determine whether its business will result in a higher or lower stock price. It looks at revenues, profits and losses, trends, the company’s business sector, and other economic growth factors that will affect the stock price.

Fundamental analysis is used in measuring the true/intrinsic value of the company behind the stock that an investor is interested to buy.

So if you intend to “own” a company by buying their shares, it is very important that you learn how to analyze its fundamentals.

You can access the financial statements of your favorite stocks at the Disclosures section of the Philippine Stock Exchange’s website. Choose the “Company Reports” tab in order to download the Annual Report of your choice stock. That should include the financial statements.

What is Technical Analysis?

Technical analysis simply ignores the the fundamental values of a company. It only looks at the movement of price and volume of shares.

The technical analyst believes that all information about a stock is already reflected in the share price. He believes that by analyzing the movements of stock prices one can predict whether it will go up or down or sideways.

Technical analysts and traders rely on charts. The charts include analytical indicators to assist traders and analysts in recognizing price trends or reversals and profit from these expected outcomes.

Where to get the technical charts of your favorite stocks?

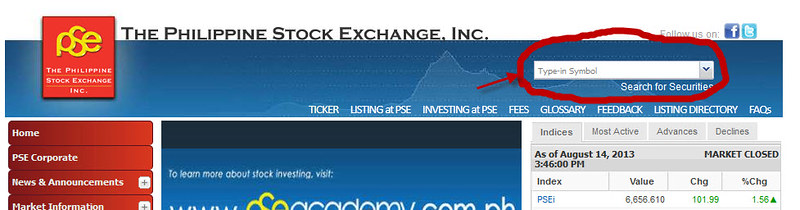

Aside from your online stockbrokers and other sites such as Bloomberg and Reuters, you can actually access the technical charts in the Philippine Stock Exchange website.

Just type in the stock code of your company in the “Search for Securities” box. See illustration below.

Upon choosing your stock code (ex. JFC – Jollibee Foods Corporation), you will be brought to the page illustrated below.

Click on the “Chart” tab in order to view the technical charts.

You will see immediately the technical charts of your choice stock as illustrated below. Please note that PSE’s website can only generate a technical chart view of maximum of two years only.

Fundamental Analysis vs. Technical Analysis

To simplify the definitions and the differences between fundamental and technical analyses, here’s a video from Investopedia.

Which technique should a new investor follow?

A lot of my new investor friends have become interested with technical analysis probably for certain reasons. Perhaps it’s the excitement in reading the charts and predicting whether the stock price will move up or down. However, technical analysis uses historical data to predict the future. This does not always work if you are looking at more than a year or two as your investing horizon.

If you as a new investor have committed to become a long-term investor, then you should learn how to do fundamental analysis. Remember that technical analysis is a technique meant for short-term to medium-term trading only.

Can a new investor do both?

It’s interesting to know that some of my friends have defined themselves as “hybrids”. I call them “cyborg investraders”. 😛

Kidding aside, it’s true that a new investor/trader can do both. However, remember that a real investor does not time the market. He/she does not look at stock price movements. He/she just wants to own a piece of that company for the long-term.

Traders, on the other hand, can benefit from using fundamental analysis together with their stock chart indicators to determine proper timing of entry in buying a good stock.

To end this article, let me ask you again. Are you an investor or a trader?

Follow my posts about investing by subscribing to BurnGutierrez.Com.

Join the OFW UsapangPiso Facebook Group and Forum to learn how to plan your finances the right way and how to grow your money in various financial instruments and investment vehicles such as stocks, mutual funds, UITF’s, bonds, money market, real estate, and others.

P.S. 1. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@yahoo.com.ph if you have any questions. Click here to join!

When I started to invest in the stock market, I started with fundamental analysis because I want to invest . For investors, fundamentals is a key …

More of investor with a little bit of market timing by flipping when the stock reaches its Fair Value. (Yes it is Strategic Average Method but I don’t want to use that term because that term is just INVENTED by TRC. SAM is not a universally recognized term. Only in the Philippines, ika nga.

I am a member of Truly Rich Club. I use TRC as my fundamental analysis and use technical analysis in timing my buying and selling. I buy only recommended stocks from TRC. But I time my buying and selling. I buy on dips on support and sell on resistance. 🙂