In the past few weeks that we’ve been giving seminars to OFW’s on how to start investing in various financial instruments, a considerable number of them have signified their interest in two most popular types of pooled funds: mutual funds or UITF’s.

One expected question and concern among them was can they really open a mutual fund account in the Philippines while they are working abroad?

Recently, we answered a question as to whether OFW’s with BDO savings accounts can invest in their UITF products. This time we will be giving our OFW’s one answer with complete procedures on how they can invest in this Philippine mutual fund even if they are currently based overseas.

Investing in Mutual Funds via Philequity

Back in the late 90s and early 2000’s, I was introduced to mutual funds by four friends from four different mutual fund companies, namely ATR Kim Eng, Philam, FAMI, and Philequity (PEMI). These are great fund companies with their respective mutual fund products performing really well in the market in the past decade.

For the benefit of our OFW readers, I will post first the details on how to invest in mutual funds via Philequity. The information that you will be reading here are based on the actual response by our friends from Philequity.

To open an account with Philequity, please follow the 4-step process below:

1) Fill up and submit the Account Opening Forms (click here).

2) Submit a copy of 1 valid Philippine ID with signature for each investor.

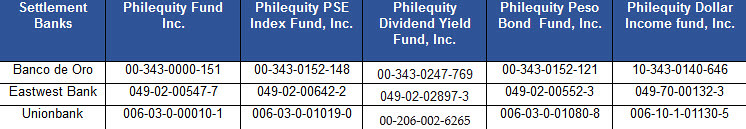

3) Make a deposit to one of Philequity’s accredited settlement bank accounts (Please refer to the attached Primer).

*Note that sending funds via remittance might delay the booking process since Philequity will have to verify if the funds have been credited to their account.

4) Submit the fully accomplished forms together with the valid ID and proof of investment (ie. deposit slip/remittance slip) to Philequity’s office:

Philequity Management, Inc.

2005 East Tower, Philippine Stock Exchange Centre

Exchange Road, Ortigas Center, Pasig City, Philippines

Do note that as mandated by the SEC, all account opening forms must be original. Philequity cannot accept scanned documents for account opening. For your convenience and to avoid errors, you may scan the documents to them for checking before you send the hard copies.

Once they receive the documents, they will contact you to schedule a Skype interview to verify the details on your forms.

These are the contact details they gave in case you have other concerns:

Philequity Management, Inc.

Trunkline : +632 689-8080

Facsimile : +632 689-8066

Email: sales@philequity.net

Website: www.philequity.net

Just keep on visiting this particular article for updates on other Philippine mutual fund companies that allow OFW’s and other Filipinos based abroad to open their investment accounts while they are outside the Philippines.

NOTE: To speed up your application, I can also help you out in opening your Philequity account even if you’re based abroad. Just email burngutierrezblog@gmail.com with the subject “MF-BurnGutierrez” and I will gladly assist you.

How About The Other Mutual Fund Companies?

Fortunately, I have partnered with the following mutual fund companies to help our OFW’s opent their investing accounts even while they are working abroad.

Here are some of the funds that are included in the list that OFW’s can choose to invest in.

If you want to know more details about these mutual funds and if you want to start investing in them, please do email me burngutierrezblog@gmail.com so I can help you.

As a final reminder, study first before investing.

Follow my posts on investing and managing finances well while abroad by subscribing to BurnGutierrez.Com for FREE.

Rock your way to abundance!

#moneyliferocknroll

P.S. 1. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. Due to popular demand, my good friend and business partner Jon Orana will be releasing again his online program called the Internet Business Master Class. This exciting online learning program is about creating and selling e-books in the internet. Here’s a FREE 23-page step-by-step guide on how to make money selling e-books including which topics to write.

P.S. 3. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

P.S. 4. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. Order your copy now from our website http://pepotanddora.com and have it delivered right at your doorstep. SOLD OUT! But you can still grab your copy yourself at The Pantry at 07 in Makati City and ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 5. If you are based abroad or just outside of Metro Manila and has been itching to learn more on how to jumpstart your business dreams, join me and my friend, serial entrepreneur Ginger Arboleda, as we take you through a series 2-hour webinars (for 11 Saturdays) that will help you focus on the technical skills and specific things that you have always wanted to know about in order to grow your business. We have come up with 10 sessions with 11 expert lecturers (with 1 FREE session if you enroll in the full program) that will make you a stronger and better entrepreneur. Register here to join the Enter Entrepreneurship Webinar Program now!

P.S. 6. Learn How To Make Money From Foreclosed Properties! We are on our 3rd run of the Usapang Foreclosed Property Investing with Jay Castillo of ForeclosurePhilippines.com! Happening on September 26, 2015 at the SMX Aura, Bonifacio Global City. Click here to register and avail the early bird promo!

P.S. 7. Buy insurance products online! Visit the very first online insurance store in the Philippines: the AXA iON! Purchase your alternative savings plan, educational plan for your children, medical emergency plan, and your life insurance by clicking HERE.

P.S. 2. The 1st Angat Pilipinas Financial Literacy Awards has opened the voting phase for the Blogger of the Year, Author of the Year awards, Advocacy Group of the Year, and the Institution of the Year Awards. Got someone or a group in mind deserving recognition? Hurry! Last day of voting is TODAY! CLICK HERE TO VOTE NOW!

P.S. 3. We’re launching the “New Rich Society” today! Know why your “sahod” is the worst income there is. You will also discover the 3-step process to grow your income starting today! Tara na! Click here!

P.S. 4. The Angat Pilipinas Coalition for Financial Literacy-OFW UsapangPiso Manila Chapter will be conducting a seminar on investing in foreclosures entitled Usapang Foreclosed Property Investing on March 21, 2015 at Lakambini Hall, Villamor Air Base in Pasay City UCC Cafe in Burgos Circle, Bonifacio Global City in Taguig featuring Jay Castillo of Foreclosure Philippines. Learning fee is only P2,500. Click here to register.

—

Photo by: Simon Cunningham

Another option is to go for their distribution channel via Rampver Strategic Advisors, where I am connected. I have helped a lot of OFWs and is guiding them from opening of account and guiding them on their financial journey until they reach their goal… The process is the same but this itme, clients will have an advisor, since whether they go direct or via Rampver, they got charged the same 3.5% entry fee.. I hope I am not biased in my satement .

I have an account with Atram since 2009 and I opened it while I was here in UAE as OFW.

That’s weird. I just inquired and I was told I have to be in the Philippines to open an account. 🙁

no need to be in the Philippines.. You can send your documents via courier. I believe Sir Burn and I are in the same company. He can help you with opening your account

That’s really odd. This was the message on the email they sent me:

Good day!

Thank you for your interest in ATR KimEng Asset Management Mutual Funds. We regret to inform you that we are unable to accept investments online. A necessary requirement for account opening is a personal/face-to-face interview to verify the identity and capacity of the potential client to fund the account.

On the other hand, when you are in Manila, we encourage you to visit us. Our office is located at the 15/F Tower One and Exchange Plaza, Ayala Triangle, Ayala Avenue, Makati City.

Please bring the following account opening requirements:

Any two (2) valid Photo-Bearing Government-Issued ID or documents

Once the relationship manager has conducted the interview and verified your documents, you may make your first subscription.

Currently, we have no auto debiting of additional subscription but we do accept electronic fund transfer for subsequent investments.

😮

Hi…

You can invest even without face to face meeting… just send documents to Rampver (their distributor) c/o Sir Burn Gutierrez). He will be very happy to help you

Very interesting. Thankyou for the info. Godbless

I think for PhilEquity required ang TIN. Some OFW don’t have TIN kaya I suggest to get your tin number first before opening an account

Good Day!

I am interested to open two FAMI mutual fund accounts (SALEF and SALBF) at the same time. I am an OFW currently based here in Bahrain.

My queries are:

1. Can I open two mutual funds at the same time? If yes, do I need to submit two separate forms?

2. For the initial investment, Can I use my metrobank direct account?

3. In submitting the documents, Is the Investment application form still necessary if I will utilize the metrobank direct to do my initial investment? If yes, what should I write there?

4. Is there any representative from your company who can check my scanned documents before sending it to your office?

I Hope to hear from you soon . Thank you!

Best Regards,

Kc

Hi KC. I will be a licensed distributor of some PH mutual funds starting this summer so I can definitely help you out. I will also visit Bahrain soon for another series of seminars. Please email burngutierrezblog@gmail.com so we can discuss more.

Good day,

I am looking for other method for additional investment in my PhilEquity MF while i am out of Philippines.

Perhaps you could assist me.

thank you.

rgds,

jeffrey

aside from remittance to MF bank account, you can do online banking or send money to your family and let them deposit to MF bank account.

hi good day !!! ofw po ako they nag iisip ko mag open ng account or mutual fund but nandito ako sa abroad if ever makapag open ako then off course sa remittance centee ko sia issent madedelay ba sia or what po thanks i hope masagot nio ang tanung ko 😀

@Aj please email me sa burngutierrezblog@gmail.com para mabigyan kita ng details on how to invest. I can help you open an account.

Is it possible to open MF with PEMI and TIN to be provided at the later date (during my vacation on December 2018)? This is the only requirement I still do not have at this time.

Hi Dennis, only Soldivo and PAMI will allow you to submit your TIN later on, as long as you can provide your SSS number. However, for other partners like Sunlife, FAMI, Philequity and ATRAM, submitting a TIN is a requirement. Email me at burngutierrezblog@gmail.com so I can assist you.

Hi po.

Sent you an email already. really interested with investing in Philequity fund. visited their website kaso nakakahilo yong mga instructions and all. Currently in Bahrain and was hoping I can open an account with them..

Hi Maricel, saw your email already. Let’s keep in touch.