There are three ways to becoming wealthy: through business, through paper assets, and through real estate. In this post, we will tackle about one of many ways to earn big bucks in the real estate investing arena: investing in foreclosures.

How do you make money from investing in foreclosures? There are various ways one can earn money through investing in foreclosures. Our friend Jay Castillo of ForeclosurePhilippines.Com has listed down all the possible ways based on what he learned in the past few years.

Here are the nine ways to earn your way to millions in foreclosed property investing:

1. Buy and Hold

This is the strategy of a person who buys a foreclosed property and holds on to it until its market value appreciates. In a nutshell. one can make money from the buy and hold strategy through the following:

– Selling the property for a profit. This assumes of course that the market value has indeed increased. Most of the time, however, it would take several years for a property to appreciate in value, and the cost of maintaining it, taxes, etc. are often not considered, hence, the owner has no idea if he will make any money when he sells his property.

– Refinancing the loan to convert the owner’s equity into cash*. Equity is the difference between the current appraised value and the loan principal balance. When the appraised value increases, the equity increases as well. To cash out the equity, one can get a new appraisal from another bank that reflects the increased market value of a property and then a new and bigger loan is secured based on this new appraisal. The original loan will then be paid for using the proceeds of the new loan and then the owner pockets the excess cash.

2. Rentals (with positive cashflow!)

Buy a property, apply minor cosmetic changes like a fresh coat of paint and have it ready for occupancy, then rent it out. At the very least, when buying a foreclosed property, the numbers should work in such a way that if you turn it into a rental property, it can generate positive cashflow.

3. Rent-to-own

With rent-to-own (which is more appropriately called a lease with an option to purchase), you give tenants the right to purchase the property for a certain amount, which is often called a downpayment. Tenants who become buyers still pay on a monthly basis but instead of paying rent, they are actually paying for the property through monthly installments.

4. Flipping

Flipping is done when one buys a property and sells it quickly for a profit. The best flipping method is when you buy a foreclosed property today, but already sold it yesterday. How, you ask? Sometimes one may already have an agreement with a buyer that he will buy a property before you have actually bought it.

5. Rehabbing

When you buy a foreclosed property that may need some repairs, fix it up, and then sell it at full market value, you call that Rehabbing, or buy-renovate-sell. If done correctly, this can result in huge profits. This is quite risky though, as cost over-runs during repairs or renovations are quite common.

6. Wholesaling

Wholesaling is buying a property way below market value and then selling it for a price slightly higher, often to other real estate investors engaged in rehabbing. Profits are not as big as profits from rehabbing because obviously the buyers would need to buy at a price with room for them to make money as well.

7. Tax Foreclosures

For tax foreclosures, one makes money when his winning bid for an auctioned property earns interest. The City Treasurer or his deputy shall return to the winning bidder the entire purchase price paid by him plus the interest of 2% per month computed from the date of sale to the date of redemption.

8. Commissions

If a foreclosed property is sold through a negotiated sale and the buyer formally notifies the bank that you are the one that referred the property to him, you can earn a commission, which is normally 5% for accredited licensed brokers.

9. Pre-foreclosures

This is when a property owner is facing foreclosure and an investor would help stop the foreclosure by buying the property, which is often the last recourse to avoid the foreclosure as the proceeds of the sale shall be used to have the mortgage fully paid. The seller often sells the property at a very low selling price, usually for what he owes plus a little cash, just to get the property sold as fast as possible. In these situations, an investor should never take advantage of the seller’s misfortune and should offer a win-win solution for everyone.

These are just some of the ways to earn from foreclosures based on Jay’s personal experience.

BATCH 3 is coming up!

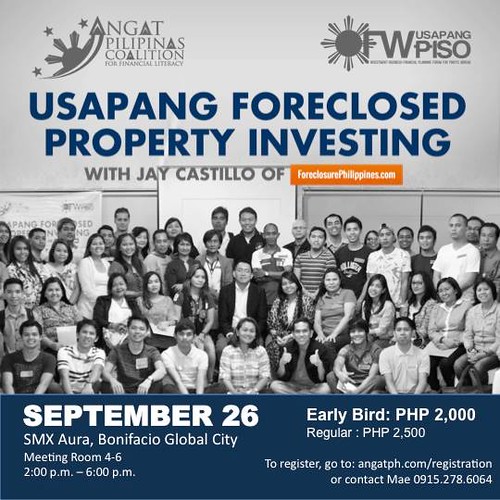

Attend the 2nd 3rd batch of the Usapang Foreclosed Property Investing seminar on September 26, 2015 at the SMX Aura Convention Center, Bonifacio Global City in Taguig City.

Early Bird: PHP 2,000 (until August 31, 2015 ONLY)

Regular (online): PHP 2,500

On the Day: PHP 3,000

* Food will be served

To register for the next Usapang Foreclosed Property Investing seminar, click the banner below or please go here-–>http://angatph.com/registration/

Learn more how to make your money grow through real estate by subscribing to BurnGutierrez.Com for FREE.

Join the OFW UsapangPiso Facebook Group to learn how to plan your finances the right way and how to grow your money in various financial instruments and investment vehicles such as stocks, mutual funds, UITF’s, bonds, money market, real estate, and others.

Rock your way to abundance!

#moneyliferocknroll

P.S. 1. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

P.S. 3. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. Order your copy now from our website http://pepotanddora.com and have it delivered right at your doorstep. Or you can grab your copy yourself at The Pantry at 07 in Makati City and ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 4. If you are based abroad or just outside of Metro Manila and has been itching to learn more on how to jumpstart your business dreams, join me and my friend, serial entrepreneur Ginger Arboleda, as we take you through a series 2-hour webinars (for 11 Saturdays) that will help you focus on the technical skills and specific things that you have always wanted to know about in order to grow your business. We have come up with 10 sessions with 11 expert lecturers (with 1 FREE session if you enroll in the full program) that will make you a stronger and better entrepreneur. Register here to join the Enter Entrepreneurship Webinar Program now!

P.S. 5. Learn How To Make Money From Foreclosed Properties! We are on our 3rd run of the Usapang Foreclosed Property Investing with Jay Castillo of ForeclosurePhilippines.com! Happening on September 26, 2015 at the SMX Aura, Bonifacio Global City. Click here to register and avail the early bird promo!

P.S. 2. The OFW UsapangPiso KSA Chapter will be conducting a series of financial literacy seminars to OFW’s in the Eastern Province and in Bahrain starting on May 23, 2014 (Al Ahsa), May 30 (International Philippine School of Al Khobar or IPSA), and June 20 (JCSGO Manama, Bahrain). Keep on visiting our Facebook group and forum site for updates on these events.

Are you going to have the same seminar here in Qatar?

Let’s see if we can have someone to sponsor us to bring this seminar to Qatar this year.

Will pass on this one, got work on saturdays…. hopefully could attend the next one.

Sponsor for Qatar seminar you can ask admins of Pinoy Ads Qatar facebook account.