So you are itching to invest in the stock market. But you don’t know what stocks or companies to buy. You join various social media groups, circles, and forums and shout out:

“What are the best companies that you recommend for a newbie to buy?”

Then you get tons of answers from intelligent, experienced, inerrable investors and traders. Sometimes you get ditched. Sometimes you receive some sermons. And most of the time they intend to get you confused even more. Okay, not all the time. 😛

Before we proceed, I want to make it clear that this post is mainly intended for aspiring and new investors. Those who have 8-5 jobs or a small businesses and are serious with their chosen crafts. Those who don’t have time to time the market. And those who value their precious time with their spouses and children.

What Should An Aspiring Investor Look for in a Company Before Investing?

It is very important to do at least some research first on the companies you’re thinking of investing in. Based on my personal experience as an accountant and auditor, one has to pay attention to the main components of a company’s financial statements.

For non-accountants/finance professionals, I will explain to you what financial statements are in simple terms in a bit. Meanwhile, here are the key items you need to look into before you buy the stocks of a company:

Income/Profit (Kita): This is usually shown as the Net Income or the Net Profit. See to it that the figures are not with the negative/minus sign (-) as numbers with this symbol indicate Loss. The Net Income should be at least 10% higher than the previous year to prove that it has outgrown inflation and other unfavorable economic factors.

Sales (Benta): Other financial statements show this as Revenues. Ensure that the current year’s Total Sales/Revenues exceed that of last year’s.

Debts/Liabilities (Utang): Would you entrust your money to a person whose debts are larger than his assets? When looking into a company’s financial condition prior to investing, make sure that its debts are lower than or similar as last year’s. The company’s assets should also be higher than its debts.

Shareholders’ Equity (Kabuuang Pag-aari): Also known as the Net Worth, the company’s total equity should be higher than the previous year. This should indicate that the people running the company have great interest in its assets and should never run out of funds for its shareholders.

What Are These Financial Statements?

For non-accountants and those who have no idea about Accounting, all companies are required to have these two major “reports” which are also called “financial statements”. They are actually the results of the company’s financial activities.

The first “report” is called the Income Statement or Profit & Loss Statement. This report shows the sales (benta), expenses (gastos), and the profit or loss (kita o bokya) of the company.

This is how an Income Statement looks like:

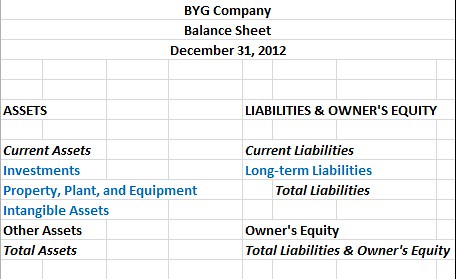

The second “report” is called the Balance Sheet. Here is where the business or the company’s total assets, liabilities, and total equity are reflected.

Remember this non-nosebleed formula:

Stockholders’ Equity = Assets – Liabilities

This is how the Balance Sheet should look like:

The Owner’s Equity or Stockholders’ Equity shows how big the interests of the shareholders are in the company. It should answer your question as to whether the value of the company is worth buying for you.

Your money will soon be part of this company’s Stockholders’ Equity should you decide to believe in it and choose it.

Remember that if you are investing, you are buying the company. You believe in the company because it has been earning for the long time and is posing to earn more in the future.

Are you ready to review the financial statements of the company of your choice? Then go here.

Click the Company Reports tab, then type in the Stock Symbol/Securities Name, and select Annual Reports from the Disclosure’s dropdown menu.

Continue receiving information on the basics of growing your money by subscribing to RockToRiches|BurnGutierrez.Com for FREE.

Rock your way to abundance!

#moneyliferockandroll

—

If you want me to coach you in improving your finances, type your name and email below and click the Subscribe button:

2 thoughts on “Know the Company’s Fundamentals Before Investing”