No matter how hard we try to warn our kababayans to observe due diligence and wise decision-making when offered by investments with guaranteed returns, many of them still do not listen and fall victims later on.

Surprisingly, some of them are aware that what they are getting into are real scams but they just shrug it off because they know that they will get their money back plus the promised returns the soonest possible time.

Those on top of the food chain do get the share of the pie. But the late bees settle for the bread crumbs if there are any at all.

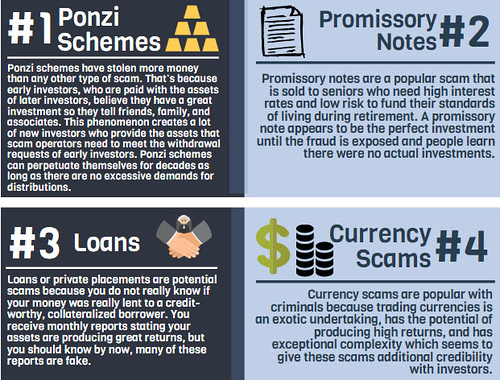

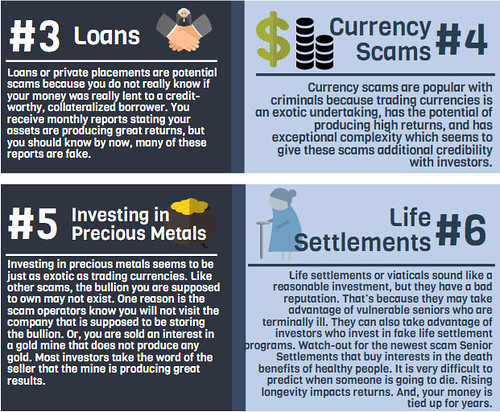

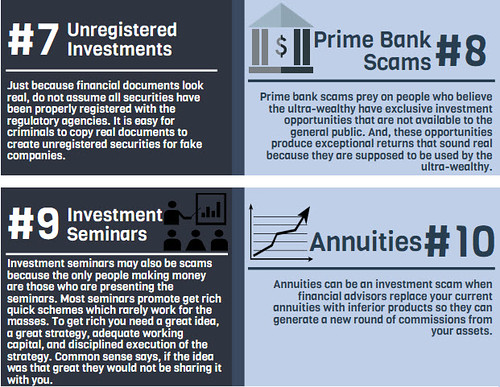

Here’s a very straightforward infographic for you to share to your friends and loved ones provided to us by Paladin Registry from the U.S.

——-

It is important that you are aware of the 10 most frequent investment scams that are perpetrated on the public by licensed and unlicensed individuals.

However, that is not your best form of protection. Why? There will be an 11th scam and a 12th scam.

Consequently, it is more important to know some of the key features of scams so you can recognize and avoid all of them.

Your Expectations

You may have noticed most investment scams promise people high returns – in some cases very high returns (30%, 40%). The scam artists know you want high returns. They are simply telling you what you want to hear. The more the scam meets your expectations for superior returns, the higher the probability you will buy it.

This is more dangerous than it may sound. The promises that are made by scam artists have to sound realistic or red flags will pop-up and you won’t buy.

That is why many of them use exotic strategies, such as currency trading, because they know there is a good chance you will not be familiar with this type of investment.

Too Good to Be True

Another good rule of thumb: “If it sounds too good to be true it is not true.”

For example, the scam artists do not just promise superior returns. He promises high returns for low risk. He has described two major investor needs (higher performance, lower risk) in the same product.

There are no lower risk products that produce higher returns. You have to give up the potential for higher returns to reduce your exposure to risks.

The Referral Game

Another characteristic of a scam is the “Referral Game.”

This is a favorite tactic of the scam artists who run Ponzi Schemes. They make sure the early investors have a very positive experience even if it is based on fake performance reports. Then they ask for referrals to the investors’ friends, family, and associates. The unfortunate investors think they are doing people they care about a favor.

Watch-out for referrals. You still have to do your homework no matter how much you trust the person who made the referral.

My Advisor is My Friend

Bernie Madoff’s clients, who lost billions of dollars in the biggest Ponzi scheme in history, lamented: “I thought he was my friend.” He was not their friend, but he used sophisticated sales and relationship skills to make them believe he was their friend.

Scam artists want you to like them. They know you let your guard down when you like someone. You like them, then you trust them, then you buy what they are selling.

The investment of your assets should not be based on personalities, sales pitches, and undocumented sales claims. It should be based on rational, objective decision-making.

The Free Lunch

A lot of scams start with the free lunch, the free round of golf, or the free seminar. A lot of investors feel indebted when they accept the free offer.

This is the opening the scam artist needs to convince you to buy what he is selling. If the scam costs you a lot of money that may just be the most expensive lunch you have ever eaten.

Do not accept free offers until you have made an objective, rational, prudent investment decision. Even then you should avoid free offers that may interfere with your ability to make the right decisions.

Source: Jack Waymire, Investor Watchdog, Paladin Registry

Avoid financial scams and be updated about the latest frauds by subscribing to Rock To Riches for FREE.

Rock your way to abundance!

#moneyliferocknroll

—

If you want me to coach you in improving your finances, type your name and email below and click the Subscribe button:

Nice article Burn, this is warning to those who want to invest their money and want big return in very short period of time.Before you invest, you must educate first yourself, don’t be fooled by promising high return for you money.

Thank you Allan! That is right, invest in education first!

I live in Canada and currently on my maternity leave.I wanted to invest but I have no knowledge about it for I was one of the victims of investment scam in the Philippines which my cousin introduced me last year.Please give me more info which is a better investment stocks or mutual funds etc? Thank you and God bless.

Hi @Francisca, both stocks and mutual funds are great investment options. However, we always emphasize the importance of specifying your goal for investing. Will it be for your retirement? Or to be used for buying a car or a house? Or for the future college education of your small child?

Once goals are identified, then we can match them with the right financial instruments. If you goals and time target is beyond 5 years, investing in stocks is the best option.

You may send me an email burngutierrezblog@gmail.com for more details.

The surest way to get scammed is to NOT know what you’re putting your money into. Like what Allan said, education is key.

If you know how things work and how the investment realistically makes money, you’ll learn to spot things that don’t make sense and are really “too good to be true.” (Your gut/instincts/intuition will usually warn you about scams.)

For insurance, make sure to do a background check on the company you’re investing in. It’s not perfect, but it’s a start.

nice!