Are you a beginner in stock investing? Have you been asking the veterans in the stock market about the “required” number of stocks that you should have in your portfolio? The truth is, their answers to you can never be the absolute reality as the real answer depends on your situation as an investor.

In the US and some Asian countries, many long time investors would advise the new ones to invest in at least 10 stocks so your portfolio can be considered as diversified. Or if possible, make it 20 stocks as long as they come from different industries.

In the Philippines, many “mentors” will tell you to keep 8 stocks at most from different industries so you can easily monitor and manage your portfolio. Others will say that you need to focus on 3 to 5 stocks only.

The truth is, your stock portfolio will depend on a few important factors: (1) financial goals, (2) risk tolerance level, (3) savings/financial capacity, (4) knowledge of stocks you intend to buy, and (5) investing time horizon.

These items should determine your investing personality, whether you are conservative or aggressive.

If you belong to a group like the Truly Rich Club, your investing strategy will most likely be conservative as the choices of stocks come mostly from the blue chip arena. Conservative means your stocks’ growth maybe slower as compared to others but are steady and sure winners in the long term as these are the most established companies in the country. That’s why our advise to our members is to maintain their stocks’ portfolio percentage to a maximum of 15% each.

And then if you belong to or have joined a stock trading mentoring group, your investing strategy and approach will be defined as aggressive since you are buying volatile, high-risk, but fast-growing stocks. Many of these are considered as penny stocks or basura stocks in the local trading lingo. These are small and starting companies that have promising probability of growth in shorter horizon.

Never Invest All Your Money in Stocks!

No matter what happens, do not exhaust all your cash from your bank accounts in order to invest in stocks. Always remember to keep a separate “portfolio” for your emergency cash. You will find out the importance of emergency funds here.

If you have already established your emergency fund, you can diversify your overall portfolio by investing in pooled funds such as mutual funds or UITFs.

Do not be too concerned if the number of stocks in your portfolio do not meet the “standards” of your gurus and mentors. Always remember that the number of stocks will depend on the five factors I mentioned above.

Do you want to be guided in stock investing using a conservative strategy? Click here now!

Subscribe to RockToRiches|burngutierrez.com for FREE!

Rock your way to abundance!

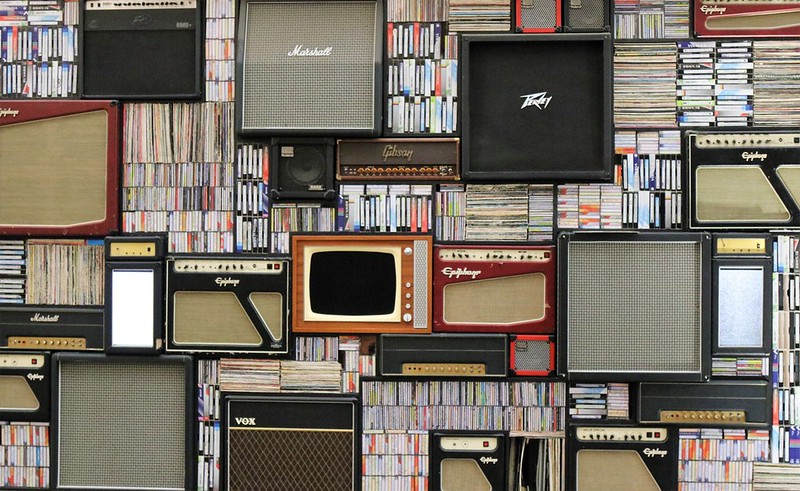

#moneyliferocknroll

—

If you want me to coach you in improving your finances, type your name and email below and click the Subscribe button: