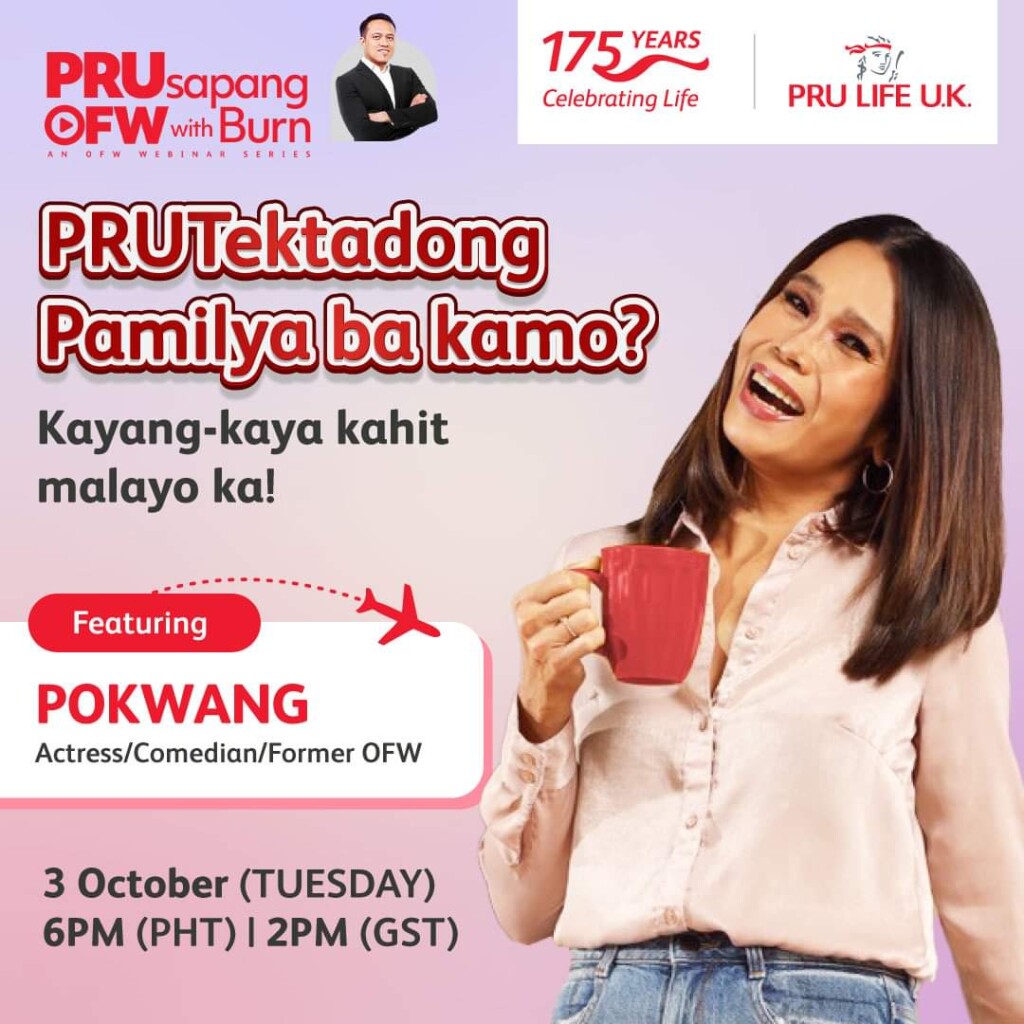

After the success of the first two webisodes of our PRUsapang OFW with Burn Gutierrez series, we are leveling up for the 3rd episode. PRULIFE UK has invited the popular actress and comedienne POKWANG as our next guest.

More than that, the webinar will be held LIVE at the PRULIFE UK Business Center in Bonifacio Global City (BGC) in-person, making it like a real TV talk show. I will be interviewing Pokwang about her experience as an OFW, her struggles in life, and her success in the local showbusiness. She will also share tips on how to get yourself and your family protected by insurance while you are still working overseas.

Register now at bit.ly/PRUSapangOFWEpisode3

So join me again on PRUsapang OFW webinar/talk show on October 3, (Tuesday), 6:00 p.m. (Manila) or 2:00 p.m. (Dubai). and learn more from our celebrity guest, Pokwang.

Register now at bit.ly/PRUSapangOFWEpisode3