Being unable to pay your debts will reflect negatively on your credit history, making it tough to take out loans in the future. It is important to keep in mind that once you decide to borrow from any lender, you take yourself to be responsible enough to pay your debts on time.

Applying for loans may be tricky but if we engage ourselves with the following scenarios, we will be able to pick up some tips on how to properly manage finances.

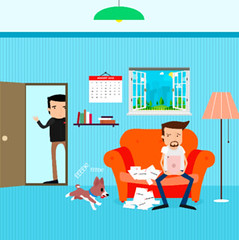

Here we have Pedro. He took out a loan for the latest rose-gold tablet. Eventually, he quit his job because he couldn’t tear himself from watching the latest episode of his favorite TV series. Because he was inactively seeking for a job, he found himself facing a problem – not having the money to pay the debt for his loan.

Here is what will happen to Pedro in the next months if he doesn’t sell his tablet or find work to pay off his loan.

Of course, it is fair to say that not all who fail to pay their debts are irresponsible just like Pedro. They can be reliable borrowers, but unforeseen circumstances such as an illness or death in the family can make it difficult or impossible to repay a loan on time. But regardless of whether one is a “Pedro” or not, the consequences of not paying a loan are the same. Let’s take a look.

We will go through 5 stages with Pedro. Within each stage, his debt will grow along with the risks of saying goodbye to his rose-gold tablet. Pedro may be confident that his health and life are not under threat because he took out a loan from a legal lender so the collection process will flow according to the law where collectors will not beat him, shout at him, or kidnap him.

Stage 1: Pre-collection. Before the due date.

The lender politely reminds Pedro that he has a due date, ensuring him to avoid delayed posting of his payment and the undesired additional charges as a consequence of being past due.

Timing: 1 – 10 days before the due date.

Charges: None.

Worst thing about it: If the lender will not succeed in getting in touch with Pedro, he will miss the due date, pay the fee, and create a negative impact on his credit record.

How to prevent it: Pay before any reminders.

In case it happens: Pay on time as advised by the lender.

Stage 2: Telephone collection. After the due date.

On the 6th season of his favorite TV series, Pedro goes past his due date. The lender is concerned about Pedro and tries to get in touch with him through calls, SMS, letters, e-mails, and even Viber. The lender wants to know what happened so he could find a solution.

Timing: Depends on the lender. Usually ranges from 1 to 60 days after the due date.

Charges: Depends on the contract. Sometimes, it is a fixed amount of Php 200 – 600 per month or a 7 to 10% interest of the amount due.

Worst thing about it: It results to a negative impact on the credit record. This will also prohibit Pedro from taking out another loan in the future. Because Pedro doesn’t pick up the phone and doesn’t pay, the worried lender will be calling his referred relatives, friends, and his employer, not disclosing any information about the debt to the third parties. But since Pedro’s former boss and colleagues, neighbor, or even his mother-in-law start receiving calls from the lending company, they might start suspecting him of having debts.

How to prevent it: Pay on time or proactively warn the lender about the payment delay. Some lenders may be considerate, which means they will stop calling for some time, offer a repayment schedule, or even waive the penalties.

In case it happens: Pay the debt or get in touch with the lender to find a solution as soon as possible. Pedro should be fair and should not give empty promises. If he promises to pay on the next day, the operator will note this in the system. If the payment is not settled, Pedro will automatically end up on the blacklist. As an option, Pedro may pay as much as he can. It will not prevent the calls but at least he will maintain his white-listed status.

Stage 3: Face-to-face collection.

Since Pedro is not picking up calls from the lender, the situation has gotten worse. The lender’s field collections officers have come to visit him at home. They are calm, polite, and will never harm anyone; but are very assertive and they know what they have to do. If unsuccessful, they will keep on coming back until the debt is paid. Sometimes, the lender passes the debt to a third party collection firm. This, unfortunately, changes nothing for Pedro.

Timing: Depends on the lender. It usually takes 60 to 180 days after the due date.

Charges: Php 100 – 300 pesos monthly.

Worst thing about it: The collectors are very assertive. They will be visiting the residence or the workplace if the borrower doesn’t pay. The neighbors and the family of Pedro may become the unwitting witnesses of him trying to explain his situation.

How to prevent it: Pay the debt before the due date or during the previous stage.

In case it happens: Pay the debt directly to the collector as soon as possible or agree on a new payment date. In this case, Pedro should keep his promise.

Stage 4: Last chance. Court.

Pedro keeps on ignoring the collectors. The lender’s next step is to pass this to the Small Claims Court. Since Pedro is too preoccupied with watching his TV series, the court hearing takes place without him. With all the documents on hand, the judge sentences Pedro to pay his debt in full immediately.

Timing: 90 days after the due date.

Charges: The debt and all the penalties plus an attorney and agency fee of Php 5,000.

Worst thing about it: Pedro will most likely lose the case. The court will sentence Pedro to pay the full debt amount including additional fees and court charges.

How to prevent it: The lender warns the borrower before filing a case. Best way is to pay off the debt before the court or try to agree with the lender on the payment schedule.

In case it happens: Visit the court hearings and fairly explain the situation to the judge. In case the borrower has voluntary signed the contract, there is no chance that the loan will be waived. The only thing the judge can do is to sentence softer conditions of repayment.

Stage 5: No chance. The debt is already with the authorities.

Pedro did not appear in court, lost his case, and didn’t pay the sentenced sum on time. The authorities will come to confiscate his rose-gold tablet.

Timing: Between 1 to 2 months.

Charges: The cumulative debt including the initial loan amount, fees, as well as the attorney and agency fee.

Worst thing about it: The authorities will take Pedro’s properties to cover all the debts: it is possible to take his favorite rose-gold tablet, flat TV, and even his pedigree dog.

How to prevent it: Find the money to pay the debt. There is no point in waiting for the authorities because they could take any property that Pedro has.

In case it happens: When the authorities come, there is nothing Pedro can do.

—

It is better not to wait for the authorities. Just settle your case with the lender.

—

We have come down to these 6 points which everyone should keep in mind:

- Not everyone who fails to pay is an irresponsible borrower. In extreme situations, everything might end very badly for the borrower.

- Lender always warns about the due date first.

- It is better to settle the debt directly with the lender.

- Before going to court, the credit record is spoiled, but still, everything is not that bad.

- If the borrower is called to the court – it’s better for him to appear.

- If the authorities come to the borrower – the game is over.

**This is a public service post from Home Credit Philippines

Learn more on how to reduce and manage your debts! Subscribe to Rock To Riches for FREE!

Rock your way to abundance!

#moneyliferocknroll