Once there was a 25-year old man named Kiko (real name withheld for security reasons) who knows nothing about investing but wanted to earn more apart from his monthly salary. He works as a janitor in a small professional firm in Makati.

One night, while doing his routine after-office cleaning, he noticed that one of the computers was left on by one of their employees who probably went off hurriedly for a Friday night gig. Kiko took the chance to browse the internet. (Yes, Fesbuk!)

Logs into his Facebook account. Enters a wrong a password….Again, again. Another wrong password. Stares deeply onto the screen. Closes his eyelids really tight. He’s forgotten his password! Or….was it hacked? Taken down by the government? Oh no R.A. 10175!!!!

While trying to recall his password matched with bleeding brains and nostrils, he accidentally clicked the mouse on a banner of a bank.

“Kahit magkano pwede i-invest?” (I can invest whatever amount?), the janitor asked the computer.

And it answered:

Definitely.

Well, half of that story was just made up for the sake of this blog. I just want to share a fact that anyone who earns, however small, can actually discipline himself to save and invest automatically that small amount of money in the stock market right away, although, INDIRECTLY through UITF’s or unit investment trust fund.

Here’s what BDO Unibank has to offer to those who are minimum wage earners, those who have no knowledge about stocks, UITFs or mutual funds, and those who just can’t afford to invest in the stock market (Most stockbrokers require you to have a minimum initial investment of Php5,000 to open your stock portfolio):

…BDO, through its Trust and Investments Group, developed the BDO Easy Investment Plan (EIP), a wealth build-up scheme that enables you to attain your financial goals and financial wellness through the twin habits of regularly saving and investing. It incorporates the best, tried and tested principles that make a successful saving and investment plan and provides a solution to counter the major obstacles to saving and investing.

To join the EIP, all you need to do is enroll your BDO checking/savings/payroll account under the BDO automatic debit facility wherein a fixed amount (with a minimum amount of PhP1,000.00) per month is deducted (once or twice a month) for immediate investment in your selected BDO Unit Investment Trust Fund (UITF). Every contribution you make participates fully in the investment performance of the selected fund as soon as the deduction is made. However, regular Confirmations of Participation (COP’s) will be issued only for accumulated contributions that have reached a market value of at least PhP 10,000.

What are UITFs?

UITFs are open-ended pooled trust funds operated and administered by a trust entity and made available by participation. Funds from various investors with similar investment objectives are pooled together into one fund, which the trust entity invests in various types of securities with the aim of maximizing returns within the level of risk allowed for that particular fund. Hence, each UITF participant has a proportionate interest in the UITF as a whole. UITFs are highly regulated and trust entities offering these are closely supervised by BSP to ensure investor protection. BDO UITFs available through the EIP are the following: BDO Peso Fixed Income Fund, BDO Peso Balanced Fund or the BDO Equity Fund.

Source: http://www.bdo.com.ph/Personal/Promos/EIP.asp

In Kiko’s case, their company deposits their salaries through BDO. On his free time, he can actually visit the BDO branch on the ground floor of their building where their payroll accounts were opened.

He can chat with the customer relations officer. Janitors and messengers are always good friends with bank staff. You wonder why.

But instead of talking about lovelife, showbiz, politics, sports, Kiko can directly ask his friendly bank friend to help him enroll his payroll account under BDO’s automatic debit facility.

The bank staff will then provide him the forms that he needs to fill out. Of course, there will more nose-bleeding moments reading through those forms. But Kiko need not worry because of his strong friendly relationship with the bank staff. And the bank manager even. They can assist him in accomplishing the forms.

But for Kiko to become a “stock market investor”, he has to select the BDO Equity Fund. Because it earns more than the two other types of UITF’s.

What is BDO Equity Fund?

The BDO Equity Fund aims primarily for capital growth over the medium to long-term by investing in a selection of exchange-listed equities . This Fund is suitable for aggressive individual and corporate investors who seek potentially higher returns through stock market investments but are also aware of the possibility of capital losses that such investments may entail.

“Investing in a selection of exchange-listed equities” means your money will be invested only in the best companies in the country.

Once a month, BDO will automatically debit or “deduct” Php1,000 from Kiko’s salary. When Kiko’s investment reaches Php10,000, his money will start to accumulate earnings, depending on the performance of the market.

There’s no guarantee though that the money he invested will always be earning on a regular basis. But with this habit of saving and investing up to his retirement age will make him become much, much, major, major richer than the other janitors in town. In Makati. Maybe even richer than the office girl who has this bad habit of leaving her computer on after work.

I bet Kiko will be grateful to that office girl for that bad habit. Coz Kiko has taken that opportunity to start his good habit of saving and investing.

And becoming richer when he retires.

For other Kiko’s and Kikay’s out there who want to grow their salary, you may visit your nearest BDO branch and inquire on how to open a savings account with no or minimal maintaining balance that you can enroll under their EIP.

So you too, can become richer like Kiko upon your retirement.

Check out BDO Easy Investment Plan for more details or download the Account Opening Kit here.

You may also call BDO Trust and Investments Group at (02) 878-4265 or (02) 878-4244 or email investments@bdo.com.ph.

Oh by the way, Kiko can just open a new Facebook account anytime he likes. It’s a fresh brand new day for him now that he’ll hop into this habit of saving and investing. 🙂

Don’t miss out my interesting features on investment topics like this. Subscribe via email for FREE at BurnGutierrez.Com.

Join the OFW UsapangPiso Facebook Group to learn how to plan your finances the right way and how to grow your money in various financial instruments and investment vehicles such as stocks, mutual funds, UITF’s, bonds, money market, real estate, and others.

Rock your way to abundance!

#moneyliferocknroll

P.S. 1. Are you an OFW who’s been looking for a investment placement where your money could grow higher than your time deposit accounts? Are you outside of Metro Manila and would like to start investing in mutual funds but have no personal advisors to help you out? Click here so I can help you open a mutual fund account NOW! .

P.S. 2. Bro. Bo Sanchez has appointed me as a coach for our young and new investors at the TrulyRichClub social site. It’s a fun, learning family with the purpose of “helping good people become rich”. I’m inviting you to join the TrulyRichClub too and email me at burngutierrezblog@gmail.com if you have any questions. Click here to join!

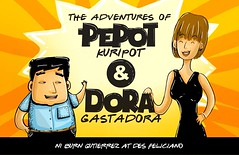

P.S. 3. My co-author/illustrator Des Feliciano and I have just launched our “The Adventures of Pepot Kuripot and Dora Gastadora” comic book! It’s arguably the first and only personal finance-influenced comic book in the Philippines. Order your copy now from our website http://pepotanddora.com and have it delivered right at your doorstep. Or you can grab your copy yourself at The Pantry at 07 in Makati City and ilovemilktea in Las Pinas City. Now available also in Australia, Saudi Arabia, and the USA! Email des_feliciano@yahoo.com for more details.

P.S. 4. If you are based abroad or just outside of Metro Manila and has been itching to learn more on how to jumpstart your business dreams, join me and my friend, serial entrepreneur Ginger Arboleda, as we take you through a series 2-hour webinars (for 11 Saturdays) that will help you focus on the technical skills and specific things that you have always wanted to know about in order to grow your business. We have come up with 10 sessions with 11 expert lecturers (with 1 FREE session if you enroll in the full program) that will make you a stronger and better entrepreneur. Register here to join the Enter Entrepreneurship Webinar Program now!

P.S. 5. Learn How To Make Money From Foreclosed Properties! We are on our 3rd run of the Usapang Foreclosed Property Investing with Jay Castillo of ForeclosurePhilippines.com! Happening on September 26, 2015 at the SMX Aura, Bonifacio Global City. Click here to register and avail the early bird promo!

P.S. 2. The OFW UsapangPiso KSA Chapter will be conducting a series of financial literacy seminars to OFW’s in the Eastern Province and in Bahrain starting on May 23, 2014 (Al Ahsa), May 30 (International Philippine School of Al Khobar or IPSA), and June 20 (JCSGO Manama, Bahrain). Keep on visiting our Facebook group and forum site for updates on these events.

P.S. 2. I’m inviting you to attend our financial coaching/Q&A session with Jess Emerson Uy, a Filipino financial consultant based in Singapore who conducts financial literacy seminars at the Philippine Embassy there, on October 9, 2013, 7PM at Starbucks Paseo de Roxas in Makati City. This Q&A session dubbed as “Starting in Global Investing” will also be webcast LIVE over at the OFW UsapangPiso Webinar site. If you are based abroad and want to interact with Jess Uy live online, then register here. Those who are in Metro Manila may get in touch with Mr. Mon Lao at 09173262077 if you want to attend the coffeetable coaching sessions for FREE with Jess Uy at Starbucks Paseo de Roxas.

P.S. 3. Do you want to learn how to earn more passive income through blogging? Attend our webinar/online seminar “Earning Through Blogging – A Crash Course on How To Build a Profitable Blog” on October 19, 2013, 3PM (Philippine time) with the Philippines’ top personal finance celebrity blogger Fitz Villafuerte of Ready To Be Rich blog. Click here for more details.

Hi Burn, sorry i got so busy. But id really like to start investing.

Have you checked out yet if your BPI account is still active?

sir ask ko lang kung nag offer din ng mutual fund at uitf ang rcbc?

Nur, ang mga major banks sa atin ay nagooffer ng UITF’s. Just remember na UITF lang ang offer ng banks at hindi mutual funds. Although pareho lang silang “pooled funds”, ang mutual funds, inooffer yan ng mga mutual fund companies.

Pakibasa mo ito para maliwanagan ka sa basic concepts ng dalawa: http://burngutierrez.com/which-mutual-fund-or-uitf-should-you-invest-in/

Ito ang mga UITF products ng RCBC: http://rcbctrust.com/uitf/

bro gusto ko yan,investment

Start na din kayo ni Pucci bro. Madali lang naman. Kung long term investment ang susundin mo, di mo na masyado kelangan maging marunong agad sa technical. Matututo ka din as you go along. Importante makapag-start na kayo. Recommend ko na invest kayo every month sa stocks or mutual funds. Even less than 1k per month makakabili ka na ng stocks. After 20 years or beyond, malaki na magiging pera mo.

Takot po kasi ako madaya at maloko….

Hindi ka naman siguro dadayain at lolokohin ng BDO. Korte ang kalalagyan nila pag ginawa nila yan sa yo. 🙂

Paano po b magsimula at magkano po ang initial investment.?waiter po ako dito sa Abu Dhabi gusto k po kasi umasenso sa buhay please guide me…ayokong maw alan ng kabuluhan ang pagpapagod ko rito…

Ernesto, unang-una. kailangan mag-set ka ng goals mo. Para saan ba ang pag-aabroad mo? Para sa pag-aaral ng mga anak mo? Para sa retirement mo? Alamin mo kung ano ang mga NEEDS mo at hindi lang mga WANTS. Ang mga WANTS, pwedeng saka mo na yan pagtuunan ng pansin kapag stable ka na financially. Baka may mga utang ka, unahin mo muna silang bayaran bago bumili ng mga bagay na di naman kailangan.

Pangalawa, magkano at paano ka nagtatabi para sa savings mo? Pinakasimpleng formula ang 70-20-10 or 70-30 budgeting. Yung 20 to 30% ng sweldo mo monthly dapat napupunta sa savings. Pagkasyahin mo lang dapat sa gastusin at padala ang 70% ng sweldo mo.

Magtabi ka din ng emergency fund mo na katumbas ng at least 6 months na gastusin mo. Halimbawa, ang NEEDS expenses mo kada buwan ay P20,000. Multiply sa 6 months = P120,000 dapat ang nakatabi mong emergency fund. Napakaimportante nyan at hindi dapat mawawala yan. Kahit 3 months lang pagipunan mo sa umpisa, pwede na.

Kapag na-address mo na ang mga bagay na nabanggit ko, pwede ka na pumasok sa mga investments at pagpapalago ng perang kinikita mo abroad katulad ng stocks, mutual funds, UITF’s, etc.

Actually, pwede mo silang pagsabay-sabayin. Ang mahalaga lang, maging disiplinado tayo sa paggastos. Sundin mo ang budgeting system na binanggit ko.

Bisita ka muna sa forum site natin para ma-assess mo kung anong investment instrument ang bagay para sa yo: http://ofw-usapangpiso.com/forum/

Sir, any suggestion po kung ano magandang UITF at mutual fund sa BPI for long term investment po ( peso cost averaging….),,baguhan po ako at maraming salamat po sa inyo ni sir fritz….nag karoon po ako ng interes mag invest. Maraming salamat po and more power po!

Hello Lorena! I suggest you for the peso-denominated Odyssey Funds of BPI. Basta select yung equity funds para mas malaki ang returns.

Salamat din at masaya kami na nakakatulong kami ni Fitz sa yong buhay pinansyal. Good luck and happy investing!

maraming salamat po Sir…..

ser bata pa lang ako hilig ko nang magbasa ng business page sa dyaryo at tingnan ang mga stock market. d ko alam ano meron don pero interesado talaga ako. sana may tutorial ka. pwede po sir pasend sa email ko links for beginners and all that.

Meron mga videos at reading materials sa mga sites at pages namin na makakatulong sa yo. Invite kita to join our Facebook group: https://www.facebook.com/groups/OFWusapangpiso/

at sa forum: http://ofw-usapangpiso.com/forum/index.php

Ito ang flagship site ng financial literacy advocacy namin: http://www.pinoymundobiz.org/

Salamat sa pagbisita mo sa blog ko. More power to you!

Sir good day pano po mag start investing sa bdo d2 po aq sa qatar wla pa aq account.

Pwede mong sabihan ang kaanak mo sa Pilipinas na mag-open muna ng Kabayan Savings account. Alam ko P50 lang para makapag-open nito. After nun, mag-enroll kamo sila sa ng BDO EIP (Easy Investment Plan).

P1,000 lang ang minimum nun, automatic ibabawas sa Kabayan account basta pondohan mo lang lagi before the scheduled date ng pagbawas para ma-invest agad sa mapipiling UITF ng pamilya mo. Kung gusto mo/nila invest sa stocks indirectly, sabihan mo sila na BDO Equity Fund ang pipiliin nilang UITF kapag nag-enrol sila ng BDO EIP.

Hi Sir Burn, OFW po ako from Doha. Fan po ako ng mga article nyo at inaabangan ko po ang pag post nyo sa facebook account ( i think every 23:00 QATAR TIME :p ) . Sobrang nakaka enlighten po ang mga blogs nyo. Kudos!

Then i called BDO and they said that to open an UITF, personal po na nasa PH. I insisted na I can open an account dito but ayaw po nila. Either umuwi po ako or family member ko po ang mag oopen para sa akin.

So I decided na mag MF muna (FAMI) with the help of Sir Mon. Fixed Income para po Long Term.

Pero gusto ko pa din po mag open ng UITF ( Equity Fund) . Saan po kaya ang pwede.

Thank you and Godbless.

Bago ako umalis ng Pinas nag enroll ako BDO Equity Fund and this month is my first COP, I’m glad that BDo have this kind of product the would help us OFW…. and Sir Gutierrez Thanks po sa mga article na ipinopost nyo. you keep us educated and informed sa mga available resources and opportunities.. more power po!

Frm Ryan of Al-Gassim, KSA

Congrats Ryan sa pagdecide mo na maginvest. Tuloy tuloy lang paginvest para sa future mo at ng pamilya mo! Join my forum para mas madami pa ang matuto mula sa experience mo: https://www.facebook.com/groups/OFWusapangpiso/

interesting article indeed..kudos to you d Janitor, naku kuya gayahin na din kita 🙂

im am also an OFW Mr. Gutierrez, what about us to qualify? as you mentioned above it was automatically debited from his semi-monthly payroll itself &/or any business individual w/o bank payroll ATM wants to invest? thanks much…

Kabayan Bong, ang importante meron kang account sa mga bangko na merong UITF products. For example sa BDO, kailangan lang meron kang SAvings Account. Kahit yung Kabayan Savings account pwede yun, P50 lang to open. Then enrol mo to for the Easy Investment Program ng UITF nila. Kahit mga relatives mo sa Pilipinas ang mag-open nyan para sa yo since dependents naman sila.

For more info, bisitahin mo ito: https://www.bdo.com.ph/personal/trust-and-investments/easy-investment-plan

Join my financial literacy forum para mas madami ka pang matutunan about financial instruments, financial planning and investing: https://www.facebook.com/groups/OFWusapangpiso/

sir Gutierrez,

What are your thoughts of Equity Fund ni Axa. Kumuha kasi ako noon. Salamat!

Hi Tom! Phil. Wealth Equity Fund or USD Equity Fund? Yung Wealth Equity, okay naman ang performance nya. As of Sept. 26, 2013, nasa 22% ang 1 year return nya. 17.73% on 3 year intervals, at 14.84% 5-year intervals. Naka-invest ang pera mo mainly sa PLDT, SM, Ayala Land, BPI, Ayala Corp. See here: http://www.axa.com.ph/FundFactSheets/Wealth%20Equity%20Fund.pdf

What are the other mutual funds that you might suggest sir? is it ok to have several mutual funds or should i focus and give it all in one?

Depends on your goals, Tom. Dedicate a mutual fund as a vehicle to achieve one specific goal. For example, if you want to travel to the US in less than 5 years, perhaps you can invest in a Balanced Fund/Fixed income fund every month. Or probably invest for the college education of your child 10 years from now, then go for another equity fund.

Check out the best performing mutual funds here: http://www.pifa.com.ph/factsfignavps.asp

For UITF’s performance this year, here’s a list prepared by PMT: http://www.pinoymoneytalk.com/returns-performance-philippine-uitf-august-2013/

Natutuwa ako sa mga comments/ answers Sir Burn. At natutuwa po ako sa inyo. Sir, OFW po ako at may online access sa BDO Kabayan Account ko. Pwede ko po ba na online na lng ako mag-apply ng Easy Investment Program? Thank you po!

Marlon, taga-Pampanga ka ba? 🙂 Unfortunately, hindi pwede na online mag-apply ng EIP sa BDO. Kailangan nasa branch sa Pilipinas ka mag-open nito. Isang option for you would be to ask your relative back home to open a Kabayan Savings account. Sabihin lang nya na dependent mo sya. Tapos yung relative mo na lang muna ang mag-open ng EIP account.

Bataan Sir. Pero ung parents ko mga taga-Pampanga ang angkan nila hehe. Ok sir, inform ko misis ko na asikasuhin. Salamat! Babasahin ko pa ung iba pa ninyong link na nai-share mo na sa iba.

every month po ba kailangan mag hulog ng 1k hanggang sa retirement mo..?

Sir if i have 1m and my goal is to make this 1m earn a lot in the next 10yrs to overcome the inflation, what kind of investment should i consider? Bdo client po ako.

Hi Buddy. Invest in an equity fund or an equity index fund. These are best for long term investment.

hello po,

gusto ko sana itanong kung kumusta po ang stockmarket ngayon?lastyear july 2015 nag invest po ako for 5yr term sa equity fund gusto ko sana itanong kung my profit na po yun?honestly diko tlga alam kong ano yun,bsta nbasa ko lng mganda mag invest dun.